KeyBank 2006 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2006 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

prevention of money laundering; devel-

oped and implemented enhanced policies

and procedures for Bank Secrecy Act

compliance and audit functions; and

enhanced our programs and controls for

Suspicious Activity Reporting. We are

definitely on the right track.

ADJUSTING THE BUSINESS MIX

You noted that Key recently sold two

businesses. Would you talk about those

in terms of changes in your business mix?

Champion Mortgage didn’t align well

with our relationship model. In particu-

lar, there wasn’t enough of an overlap

with our branch network to efficiently

expand the number of relationships with

Champion’s clients.

With McDonald’s brokerage business,

we had a scale issue. We came to a point

where we needed to make more technol-

ogy and marketing investments in the

business, or sell it to a company that had

the strategy and capital to do so. Now we

can focus our full attention on delivering

private banking, wealth management,

trust services, mutual funds and annuities

directly through our banking offices.

Although we sold the branch office

network, it’s important to recognize

that we retained the portion of the

former McDonald organization that

has been a particularly valuable strategic

fit: the institutional businesses. Areas

such as investment banking, capital

markets, research, public finance and

fixed income have added expertise – and

revenue – to our corporate and institu-

tional banking areas.

Some observers have suggested that Key

is too geographically dispersed. Have you

considered consolidating your banking

footprint?

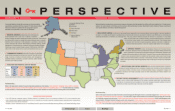

We’ve certainly heard that comment –

more so in the past than currently. I think

many analysts have come to realize – as

we have – the opportunities our broad

Maine-to-Alaska footprint offers us.

First, facing different competitors in four

regions of the country is an advantage

when it comes to pricing and gathering

deposits. Second, our geographic diversity

gives us a risk-management benefit. For

instance, while loan growth in one region

may be modest, we may experience

robust growth in others.Third, it offers us

many opportunities to grow. Our strategy

is to complete fill-in acquisitions in those

markets where we are underrepresented.

Is that reflected in your M&A activity?

Yes. Over the past several years, we’ve

completed several fill-in acquisitions, such

as those in Denver, Detroit and Seattle.

But we’re also eager to do acquisitions

that support our national businesses –

including KeyBank Real Estate Capital,

Key Equipment Finance and Victory

Capital Management. Recent acquisi-

tions in these businesses, such as Austin

Capital Management, American Express

Business Finance, the servicing unit of

ORIX Capital Markets and Malone

Mortgage Company have added clients,

scale, offices and expertise.

LEADERSHIP AND VALUES

Henry, you mentioned bringing on Beth

Mooney as a vice chair in 2006. She was

the latest, but you already had recruited

three other new direct reports over the last

four years. Tell us about that.

I’m particularly proud of the success

we’ve had attracting top talent. Since

2001, we’ve added Tom Bunn, who heads

our National Banking business, Jeff

Weeden as our chief financial officer,

Chuck Hyle, our chief risk officer, and

now Beth. Tom Stevens, our chief admin-

istrative officer, has been with me from

the time I became CEO. I believe that

any one of our new executives would

tell you that they came here to lead

change in a changing industry. I’d also

note that we’ve attracted terrific people at

all levels of the company,moreso than

we have in the past. From where I sit, this

ability is increasingly a strategic compet-

itive advantage for us.

What do you look for in new Key leaders?

Is there a common thread?

Weplace a great deal of emphasis on

leadership and teamwork. We look

closely at a candidate’s attraction to, and

fitwith our culture. Wehirefor what we

call our Key Values – teamwork, respect,

integrity, accountability and leadership.

We support team decisions. We expect

our leaders to cast a shadow of respectful,

trusting relationships with teammates,

clients and community leaders. I also look

for people who have a dose of humility.

I think that contributes to the develop-

ment of leaders who can trust and rely on

their staffs and colleagues.

Sounds as if living Key Values is as important

to Key’s success as an individual’s func-

tional skills.

Absolutely. Functional skills that allow

us to offer the best financial solutions to

our clients at the right time are an impor-

tant partof the equation. But Key’ssuc-

cess also is driven by how we interact

with each other,lead with vision and

passion, develop our workforce and live

our Values, day in and day out. Knute

Rockne was right: The best 11 players

always beat the 11 best players. In other

words, a well-functioning, high-per-

forming team trumps a bunch of high-

performing individuals who may not

work together particularly well.

How do your expectations for leadership and

teamwork translate into the development of

Key’sCommunity Banking and National

Banking organizations? How do you get the

two business organizations to work together

for the benefitof clients and shareholders?

It starts with a leadership team that

truly understands that we do what’s right

for the client and best for the company,

not what’s necessarily best for a line of

business or an individual. There’s only

one stock traded and that’sKeyCorp

stock. Teamwork has become a differ-

entiator for those Key leaders who are

recruited or move up in the company.

Key 2006 57

Next Page

Search

Previous Page