KeyBank 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25Key 2006

INTERVIEW WITH CEO

HENRY MEYER

BUILDING A TRADITION

OF TOP-TIER

PERFORMANCE

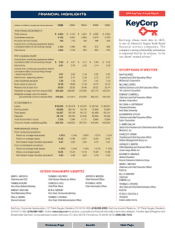

Key reported income from continuing operations of $1.2 billion in

2006, or $2.91 per diluted common share, the highest level of

earnings in the company’s history. These positive results were

driven by solid commercial loan growth and asset quality, higher income

from fee-based businesses and growth in core deposits. During 2006,

total revenue from continuing operations rose by $219 million to $4.9

billion. Including the results of the Champion Mortgage divestiture,

which was accounted for as a discontinued operation, the company’snet

income was $1.06 billion, or $2.57 per share.

Late in 2006, Standard and Poor’s again named Key a “Dividend

Aristocrat” – listing the company as one of 59 U.S. companies that

has increased its dividend each year for more than 25 consecutive

Next Page

Search

Previous Page