KeyBank 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 5Key 2006

Focus. Alignment. Accountability.

Spend five minutes with Vice Chair Tom

Bunn talking strategy for Key National

Banking (KNB) and you’ll hear those

three words at least once. Spend an hour

and they will be repeated enough for you

to know – very clearly – just how impor-

tant those concepts were to the success of

the KNB organization in 2006.

Building lasting, profitable client rela-

tionships, Bunn says, requires focusing on

those clients where Key can make a dif-

ference; aligning the optimal set of busi-

nesses and professional expertise around

those targeted clients; and developing an

organization that holds itself consistently

accountable for teamwork and results

that create value for both clients and Key

shareholders.

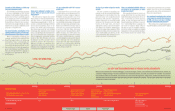

This disciplined business approach

helped drive strong 2006 financial results.

“Wehad a good – and balanced – year in

2006,” Bunn says. “That’s gratifying dur-

ing a period when the inverted yield curve

made for tough sledding in some busi-

nesses.”

Accounting for 59 percent of Key’s

total earnings, National Banking earned

$701 million in 2006 from continuing

operations, up 11 percent from the pre-

vious year.Bolstered by an increase in fees

from investment banking and capital

markets activities, noninterest income

increased 9 percent to $1.1 billion. Total

revenue increased to $2.5 billion, up 9

percent, as average commercial loans and

leases outstanding increased by 10 per-

cent, to $37.8 billion, and average com-

mercial deposits grew 43 percent, to

$10.9 billion.

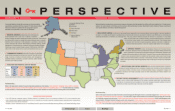

KNB’s diverse business mix enables

Key clients to lease jets, telecommunica-

tions or computer equipment; finance

major shopping malls or 300-home

developments; borrow for a yacht or their

children’seducation; take their private

company public; or obtain advice on the

management of company pension funds

or investment portfolios, among many

other services.

NATIONAL BANKING

ASOLID

AND BALANCED

2006

Next Page

Search

Previous Page