KeyBank 2006 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2006 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 5Key 2006

Icame to Key because I share its values,”

notes Key Vice Chair Beth Mooney.

“I believe in Henry Meyer’s vision

for the company. And I’m passionate

about our community banking model,

which creates excellent opportunities for

profitable growth.”

Mooney joined Key in May 2006 to

lead Community Banking, or as CEO

Meyer puts it, “to champion our vision

for Community Banking and bring that

vision to life.”

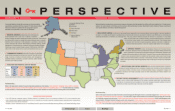

Community Banking serves individu-

als, small businesses and a significant

portion of the commercial middle-market

in 13 states from Maine to Alaska. Every

day, its nearly 9,000 employees interact

with tens of thousands of clients who can

conduct business at any one of 950

branches or through Key’s call centers,

award-winning website or robust ATM

network.

Mooney thinks of her business as a

community-centric endeavor, best man-

aged and executed by local leaders who

are responsible and accountable for the

performance of their respective districts.

“But our local teams are backed by a

corporation with more than $92 billion in

assets,” says Mooney. “We’re creating an

organization with a national presence

that can deliver with the speed, efficiency

and flexibility of a local bank. It’s

absolutely the right way to go.”

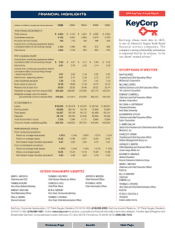

2006 RESULTS

Community Banking earned $427

million in 2006, up 2 percent from the

previous year. Those results accounted

for 36 percent of Key’s total earnings

from continuing operations. Interest

income – challenged by tighter interest

rate spreads and fierce competition for

deposits – rose 3 percent, to $1.8 billion,

while noninterest income increased

.5 percent, to $892 million, driven by

increases in annuity fee income, electronic

banking fees and service charges on

deposit accounts. Total revenue, at $2.6

billion, was up 2 percent from 2005.

Average deposits grew to $46.7 billion

in 2006, up 5 percent from the previous

year. Average loans and leases decreased

1percent to $26.7 billion.

Mooney believes Community Banking

can do better. “We’re not where we want

to be or where we’re going to be. But I

“

RALLYING

KEY COMMUNITY BANKING

AROUND CLIENTS

Next Page

Search

Previous Page