KeyBank 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Key 2006 53

2006 PERFORMANCE

Henry, an overview on Key’s 2006 perform-

ance seems like a good place to start.

We performed well in 2006, despite

rising interest rates, an inverted yield

curve and fierce pricing competition.

Based on continuing operations, full-

year earnings per share (EPS) of $2.91

surpassed the previous year’s EPS by

11 percent. In 2006, we advanced our

strategic goal of improving our busi-

ness mix and risk profile by deciding to

divest Champion Mortgage in November

and the McDonald Investments

branch network, which closed in

February2007. We also acquired

Austin Capital Management. Austin

expands Victory Capital Management’s

portfolio of products to include hedge

funds. Further, our asset quality remained

solid during 2006.

What factors were the primarydrivers of

Key’s performance?

We had several. Average commercial

loans wereup 7 percent over 2005, while

average core deposits increased 8 percent.

Income from our fee-based businesses

rose 3 percent, driven principally by

operating leases and investment banking

income.

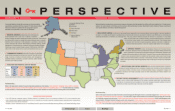

Could you elaborate on the strategic actions

you took to adjust Key’s business mix?

Over the last few years, we’ve worked

hard to position Key for the long haul.

The goal has been to move us up into the

higher-performing tier of banks in our

peer group. To do that, we’ve completed

15 acquisitions and divestitures (see pages

4and 5) to adjust our business mix. We

now have significantly improved our asset

quality and attained a much better risk

profile. We’ve also recruited talented

executives to lead the effort and they, in

turn, have developed teams that are

getting the job done.

How did 2006 results square with Key’s

long-term financial goals?

Our EPS goal is 8 to 10 percent growth

annually. As I said, we grew EPS 11 percent

in 2006. Return on equity (ROE)

improved to 15.43 percent in 2006, close

to our long-term goal of 16 to 18 percent.

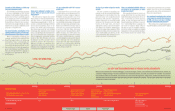

STOCK PRICE APPRECIATION

You often refer to your stock price as your

“report card.” How did Key’s stock perform

in 2006?

Our stock price was up 15 percent

for the year, and, during the fourth

quarter, Key shares reached the highest

closing price since July 1998. The total

return on Key stock, which includes the

dividend, was up 20 percent in 2006,

outperforming the 16 percent increase

in total return recorded by the S&P Banks

Index for the same period.

You did beat the S&P Banks Index last year.

How have you done longer-term?

We’ve now beaten the index three

years running. If you look back five years,

the story gets even better. Our total return

over that time is up 92 percent, com-

pared with about 64 percent for the

Banks Index and 35 percent for the broad

S&P Index (see pages 4 and 5). That

means that a shareholder who was

invested continually in Key since 2001

saw his or her investment nearly double

by the end of 2006.

Capital ratios are an indicator of a bank’s

financial strength. How does Key fare in

this area?

Our tangible equity to total assets

capital ratio – one of a number of impor-

tant ratios tracked in our industry – is

strong. That gives us the flexibility to pay

dividends, invest in our core businesses,

take advantage of acquisition opportu-

nities and repurchase our stock. As much

as we value organic growth, we know that

taking advantage of appropriate acquisi-

tion opportunities is essential to achieving

the long-termgrowth rates we want from

our businesses.

INDUSTRY OVERVIEW

Wall Street and investors generally are

watching for a turning point in the industry,

when credit quality reverses course and

begins to worsen. Do you believe that

happened in 2006?

The past two years have been two of

the best ever in terms of credit quality, for

Key and the industry.It’s clear that we’re

now at an inflection point where credit

quality industry-wide is much more

likely to worsen than improve. The

Federal Reserve Board has moved to ease

inflationary pressure through a steady

escalation in interest rates. The result to

date has been slower economic growth,

but not an economic downturn.

KEY’S

STRONG DIVIDEND HISTORY

dividend amounts in dollars

years. The Board of Directors increased

Key’s dividend in January 2007, for the

42nd consecutive year, to $1.46 per

common share on an annualized basis.

The Board also expanded its share

repurchase authorization by 25 million

shares, underscoring its confidence in

Key’s leadership and direction.

In the following wide-ranging Q&A,

Henry Meyer, Key’s chief executive

officer since 2001, comments on topics

including Key’s 2006 financial perform-

ance, its stock valuation, its longer-term

priorities and strategy, the industry

outlook and what he looks for in Key’s

leaders. Questions developed for this

interview were compiled from those

Meyer is asked most frequently by

individual and institutional investors,

analysts, employees, the news media

and community leaders.

Next Page

Search

Previous Page