Johnson Controls 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

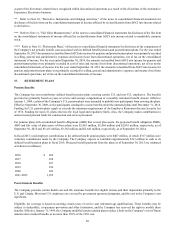

In November 2013, the Company's Board of Directors authorized a $3 billion increase in the Company's share repurchase program,

which brought the total authorized amount under the repurchase program to $3.65 billion. The share repurchase program does not

have an expiration date and may be amended or terminated by the Board of Directors at any time without prior notice. During

fiscal 2015 and 2014, the Company repurchased approximately $1.4 billion and $1.2 billion of its common shares, respectively.

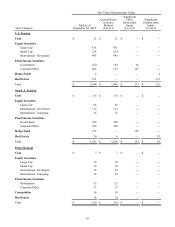

The Company consolidates certain subsidiaries in which the noncontrolling interest party has within their control the right to

require the Company to redeem all or a portion of its interest in the subsidiary. The redeemable noncontrolling interests are reported

at their estimated redemption value. Any adjustment to the redemption value impacts retained earnings but does not impact net

income. Redeemable noncontrolling interests which are redeemable only upon future events, the occurrence of which is not currently

probable, are recorded at carrying value.

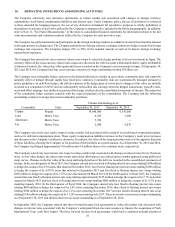

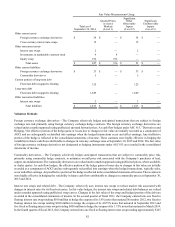

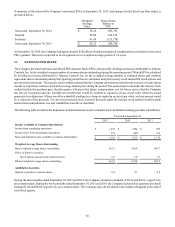

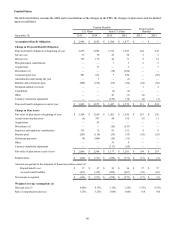

The following schedules present changes in the redeemable noncontrolling interests (in millions):

Year Ended

September 30, 2015 Year Ended

September 30, 2014 Year Ended

September 30, 2013

Beginning balance, September 30 $ 194 $ 157 $ 253

Net income 51 38 48

Foreign currency translation adjustments (23) — 1

Realized and unrealized gains on derivatives 1——

Change in noncontrolling interest share — — (63)

Dividends (11)(7)(23)

Redemption value adjustment — — (59)

Other — 6 —

Ending balance, September 30 $ 212 $ 194 $ 157

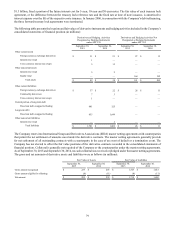

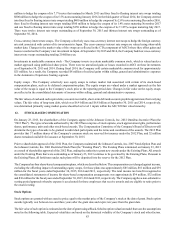

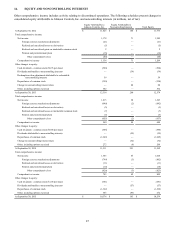

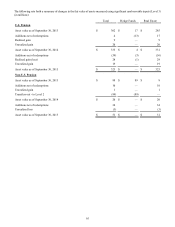

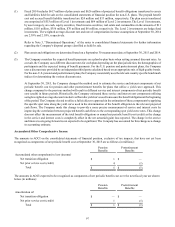

The following schedules present changes in AOCI attributable to Johnson Controls, Inc. (in millions, net of tax):

Year Ended

September 30,

2015

Year Ended

September 30,

2014

Year Ended

September 30,

2013

Foreign currency translation adjustments

Balance at beginning of period $ (248) $ 392 $ 413

Aggregate adjustment for the period (net of tax effect of $(44), $7 and $19) * (799) (640) (21)

Balance at end of period (1,047) (248) 392

Realized and unrealized gains (losses) on derivatives

Balance at beginning of period 4 7 12

Current period changes in fair value (net of tax effect of $(4), $(1) and $(2)) (5) (3) (2)

Reclassification to income (net of tax effect of $(3), $0 and $(2)) ** (6) — (3)

Balance at end of period (7) 4 7

Realize and unrealized gains (losses) on marketable common stock

Balance at beginning of period — 7 5

Current period changes in fair value (net of tax effect of $0) — (1) 2

Reclassifications to income (net of tax effect of $0, $(2) and $0) *** — (6) —

Balance at end of period — — 7

Pension and postretirement plans

Balance at beginning of period 7 12 28

Reclassification to income (net of tax effect of $(3), $(3) and $(9)) **** (11) (4) (18)

Other changes (net of tax effect of $0) 1 (1) 2

Balance at end of period (3) 7 12

Accumulated other comprehensive income (loss), end of period $ (1,057) $ (237) $ 418

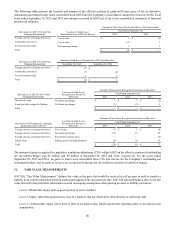

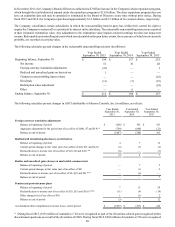

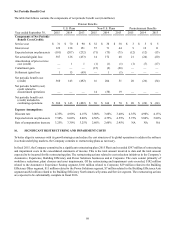

* During fiscal 2015, ($19) million of cumulative CTA were recognized as part of the divestiture-related gain recognized within

discontinued operations as a result of the divestiture of GWS. During fiscal 2014, $203 million of cumulative CTA were recognized