Johnson Controls 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

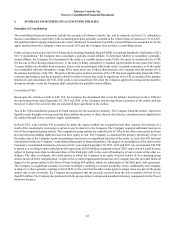

70

administrative expenses on the consolidated statements of income and reduced goodwill by $15 million in the Automotive

Experience Seating segment, and recorded a loss, net of transaction costs, of $22 million within selling, general and administrative

expenses on the consolidated statements of income in the Building Efficiency Other segment.

3. DISCONTINUED OPERATIONS

In the second quarter of fiscal 2015, the Company completed the sale of its interests in two GWS joint ventures to Brookfield

Asset Management, Inc. On March 31, 2015, the Company announced that it had reached a definitive agreement to sell the remainder

of the GWS business to CBRE Group Inc., subject to regulatory and other approvals. The sale closed on September 1, 2015. The

agreement includes a 10-year strategic relationship between the Company and CBRE. The Company will be the preferred provider

of HVAC equipment, building automation systems and related services to the portfolio of real estate and corporate facilities managed

globally by CBRE and GWS. The Company also engages GWS for facility management services. The annual cash flows resulting

from these activities with the legacy GWS business are not expected to be significant.

At March 31, 2015, the Company determined that its GWS segment met the criteria to be classified as a discontinued operation,

which required retrospective application to financial information for all periods presented. The Company did not allocate any

general corporate overhead to discontinued operations. The assets and liabilities of the GWS segment were reflected as held for

sale in the consolidated statements of financial position at September 30, 2014.

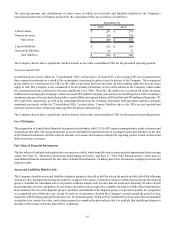

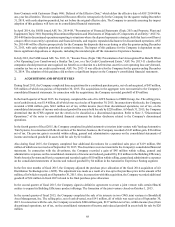

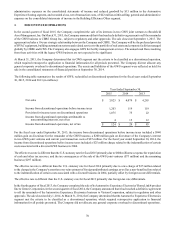

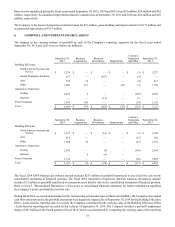

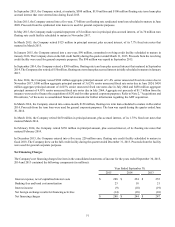

The following table summarizes the results of GWS, reclassified as discontinued operations for the fiscal years ended September

30, 2015, 2014 and 2013 (in millions):

Year Ended September 30,

2015 2014 2013

Net sales $ 3,025 $ 4,079 $ 4,265

Income from discontinued operations before income taxes 1,203 119 119

Provision for income taxes on discontinued operations 1,075 75 22

Income from discontinued operations attributable to

noncontrolling interests, net of tax 4 15 12

Income from discontinued operations, net of tax $ 124 $ 29 $ 85

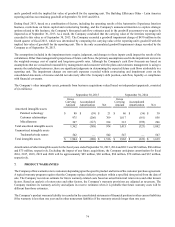

For the fiscal year ended September 30, 2015, the income from discontinued operations before income taxes included a $940

million gain on divestiture for the remainder of the GWS business, a $200 million gain on divestiture of the Company's interest

in two GWS joint ventures and current year transaction costs of $87 million. For the fiscal year ended September 30, 2014, the

income from discontinued operations before income taxes included a $25 million charge related to the indemnification of certain

costs associated with a divested GWS business in 2004.

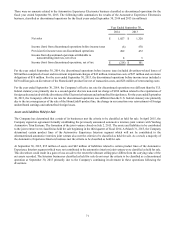

The effective tax rate is different than the U.S. statutory rate for fiscal 2015 primarily due to $680 million tax expense for repatriation

of cash and other tax reserves, and the tax consequences of the sale of the GWS joint ventures ($73 million) and the remaining

business ($297 million).

The effective tax rate is different than the U.S. statutory rate for fiscal 2014 primarily due to a tax charge of $35 million related

to the change in the Company's assertion over reinvestment of foreign undistributed earnings as well as a non-benefited loss related

to the indemnification of certain costs associated with a divested business in 2004, partially offset by foreign tax rate differentials.

The effective rate is different than the U.S. statutory rate for fiscal 2013 primarily due foreign tax rate differentials.

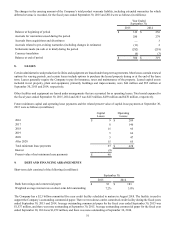

In the fourth quarter of fiscal 2013, the Company completed the sale of its Automotive Experience Electronics' HomeLink® product

line to Gentex Corporation. In the second quarter of fiscal 2014, the Company announced that it had reached a definitive agreement

to sell the remainder of the Automotive Experience Electronics business to Visteon Corporation, subject to regulatory and other

approvals. The sale closed on July 1, 2014. At March 31, 2014, the Company determined that the Automotive Experience Electronics

segment met the criteria to be classified as a discontinued operation, which required retrospective application to financial

information for all periods presented. The Company did not allocate any general corporate overhead to discontinued operations.