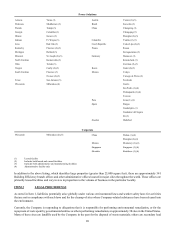

Johnson Controls 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

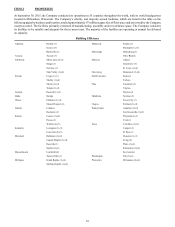

Building Efficiency Risks

Failure to comply with regulations due to our contracts with U.S. government entities could adversely affect our business

and results of operations.

Our Building Efficiency business contracts with government entities and is subject to specific rules, regulations and approvals

applicable to government contractors. We are subject to routine audits by the Defense Contract Audit Agency to assure our

compliance with these requirements. Our failure to comply with these or other laws and regulations could result in contract

terminations, suspension or debarment from contracting with the U.S. federal government, civil fines and damages and criminal

prosecution. In addition, changes in procurement policies, budget considerations, unexpected U.S. developments, such as terrorist

attacks, or similar political developments or events abroad that may change the U.S. federal government’s national security defense

posture may adversely affect sales to government entities.

Volatility in commodity prices may adversely affect our results of operations.

Increases in commodity costs negatively impact the profitability of orders in backlog as prices on those orders are fixed; therefore,

in the short-term we cannot adjust for changes in commodity prices. If we are not able to recover commodity cost increases through

price increases to our customers on new orders, then such increases will have an adverse effect on our results of operations.

Additionally, unfavorability in our hedging programs during a period of declining commodity prices could result in lower margins

as we reduce prices to match the market on a fixed commodity cost level.

Conditions in the commercial and residential new construction markets may adversely affect our results of operations.

HVAC equipment sales in the commercial and residential new construction markets correlate to the number of new buildings and

homes that are built. The strength of the commercial and residential markets depends in part on the availability of commercial and

consumer financing for our customers, along with inventory and pricing of existing buildings and homes. If economic and credit

market conditions decline, it may result in a decline in the construction of new commercial buildings and residential housing

construction market. Such conditions could have an adverse effect on our results of operations and result in potential liabilities or

additional costs, including impairment charges.

A variety of other factors could adversely affect the results of operations of our Building Efficiency business.

Any of the following could materially and adversely impact the results of operations of our Building Efficiency business: loss of,

changes in, or failure to perform under guaranteed performance contracts with our major customers; cancellation of, or significant

delays in, projects in our backlog; delays or difficulties in new product development; the potential introduction of similar or superior

technologies; financial instability or market declines of our major component suppliers; the unavailability of raw materials

(primarily steel, copper and electronic components) necessary for production of HVAC equipment; price increases of limited-

source components, products and services that we are unable to pass on to the market; unseasonable weather conditions in various

parts of the world; changes in energy costs or governmental regulations that would decrease the incentive for customers to update

or improve their building control systems; revisions to energy efficiency or refrigerant legislation; and natural or man-made disasters

or losses that impact our ability to deliver products and services to our customers.

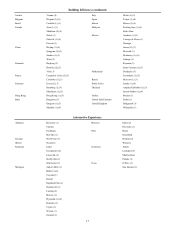

Automotive Experience Risks

Unfavorable changes in the condition of the global automotive industry may adversely affect our results of operations.

Our financial performance depends, in part, on conditions in the automotive industry. In fiscal 2015, our largest customers globally

were automobile manufacturers Ford Motor Company (Ford), Fiat Chrysler Automobiles N.V. (Chrysler), General Motors

Corporation (GM), Daimler AG and Toyota Motor Corporation (Toyota). If automakers experience a decline in the number of new

vehicle sales, we may experience reductions in orders from these customers, incur write-offs of accounts receivable, incur

impairment charges or require additional restructuring actions beyond our current restructuring plans, particularly if any of the

automakers cannot adequately fund their operations or experience financial distress. In addition, such adverse changes could have

a negative impact on our business, financial condition or results of operations.

We are subject to pricing pressure from our automotive customers.

We face significant competitive pressures in our automotive business segments. Because of their purchasing size, our automotive

customers can influence market participants to compete on price terms. If we are not able to offset pricing reductions resulting