Johnson Controls 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

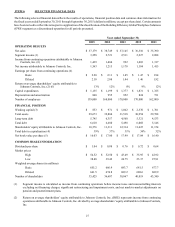

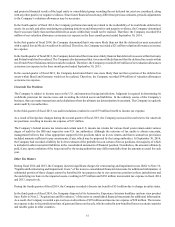

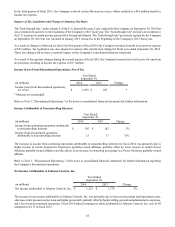

In the fourth quarter of fiscal 2015, the Company performed an analysis related to the realizability of its worldwide deferred tax

assets. As a result, and after considering tax planning initiatives and other positive and negative evidence, the Company determined

that it was more likely than not that certain deferred tax assets primarily within Spain, Germany and the United Kingdom would

not be realized and it is more likely than not that certain deferred tax assets of Poland and Germany will be realized. The impact

of the net valuation allowance provision offset the benefit of valuation allowance releases and, as such, there was no net impact

to income tax expense in the three month period ended September 30, 2015.

In the fourth quarter of fiscal 2014, the Company performed an analysis related to the realizability of its worldwide deferred tax

assets. As a result, and after considering tax planning initiatives and other positive and negative evidence, the Company determined

that it was more likely than not that deferred tax assets within Italy would not be realized. Therefore, the Company recorded $34

million of net valuation allowances as income tax expense in the three month period ended September 30, 2014.

In the first quarter of fiscal 2014, the Company determined that it was more likely than not that the deferred tax asset associated

with a capital loss in Mexico would not be utilized. Therefore, the Company recorded a $21 million valuation allowance as income

tax expense.

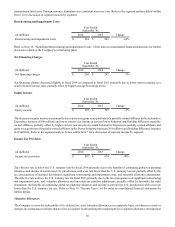

Uncertain Tax Positions

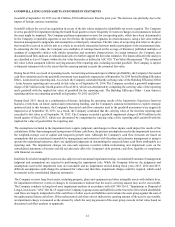

The Company is subject to income taxes in the U.S. and numerous foreign jurisdictions. Judgment is required in determining its

worldwide provision for income taxes and recording the related assets and liabilities. In the ordinary course of the Company’s

business, there are many transactions and calculations where the ultimate tax determination is uncertain. The Company is regularly

under audit by tax authorities.

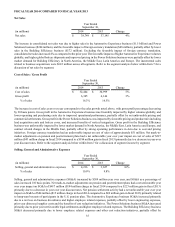

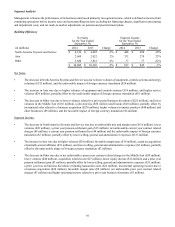

During fiscal 2015, the Company settled a significant number of tax examinations in Germany, Mexico and the U.S., impacting

fiscal years 1998 to fiscal 2012. The settlement of unrecognized tax benefits included cash payments for approximately $440

million and the loss of various tax attributes. The reduction for tax positions of prior years is substantially related to foreign

exchange rates. In the fourth quarter of fiscal 2015, income tax audit resolutions resulted in a net $99 million benefit to income

tax expense.

The Company’s federal income tax returns and certain non-U.S. income tax returns for various fiscal years remain under various

stages of audit by the IRS and respective non-U.S. tax authorities. Although the outcome of tax audits is always uncertain,

management believes that it has appropriate support for the positions taken on its tax returns and that its annual tax provisions

included amounts sufficient to pay assessments, if any, which may be proposed by the taxing authorities. At September 30, 2015,

the Company had recorded a liability for its best estimate of the probable loss on certain of its tax positions, the majority of which

is included in other noncurrent liabilities in the consolidated statements of financial position. Nonetheless, the amounts ultimately

paid, if any, upon resolution of the issues raised by the taxing authorities may differ materially from the amounts accrued for each

year.

Other Tax Matters

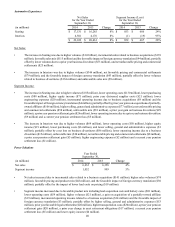

During fiscal 2015 and 2014, the Company incurred significant charges for restructuring and impairment costs. Refer to Note 16,

"Significant Restructuring and Impairment Costs," of the notes to consolidated financial statements for additional information. A

substantial portion of these charges cannot be benefited for tax purposes due to our current tax position in these jurisdictions and

the underlying tax basis in the impaired assets, resulting in $52 million and $75 million incremental tax expense in fiscal 2015

and 2014, respectively.

In the fourth quarter of fiscal 2015, the Company completed its global automotive interiors joint venture with Yanfeng Automotive

Trim Systems. Refer to Note 2, "Acquisitions and Divestitures," of the notes to consolidated financial statements for additional

information. In connection with the divestiture of the Interiors business, the Company recorded a pre-tax gain on divestiture of

$145 million, $38 million net of tax. The tax impact of the gain is due to the jurisdictional mix of gains and losses on the divestiture,

which resulted in non-benefited expenses in certain countries and taxable gains in other countries. In addition, in the third and

fourth quarters of fiscal 2015, the Company provided income tax expense for repatriation of foreign cash and other tax reserves

associated with the Automotive Experience Interiors joint venture transaction, which resulted in a tax charge of $75 million and

$223 million, respectively.

During the fourth quarter of fiscal 2014, the Company recorded a discrete tax benefit of $51 million due to change in entity status.