Johnson Controls 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Johnson Controls annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

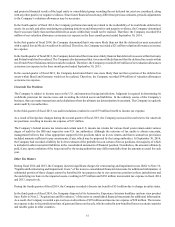

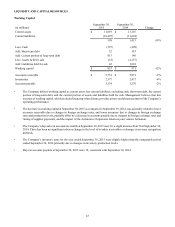

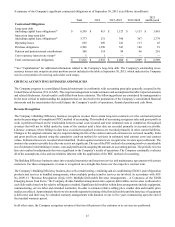

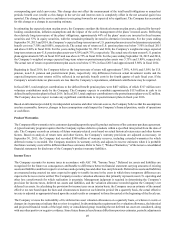

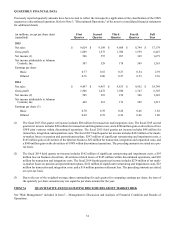

A summary of the Company’s significant contractual obligations as of September 30, 2015 is as follows (in millions):

Total 2016 2017-2018 2019-2020 2021

and Beyond

Contractual Obligations

Long-term debt

(including capital lease obligations)* $ 6,558 $ 813 $ 1,127 $ 1,153 $ 3,465

Interest on long-term debt

(including capital lease obligations)* 3,773 231 396 367 2,779

Operating leases 628 209 241 113 65

Purchase obligations 2,296 1,550 547 180 19

Pension and postretirement contributions 560 114 89 96 261

Cross-currency interest rate swaps* 1 1 — — —

Total contractual cash obligations $ 13,816 $ 2,918 $ 2,400 $ 1,909 $ 6,589

* See "Capitalization" for additional information related to the Company's long-term debt. The Company's outstanding cross-

currency interest rate swaps in an asset position are not included in the table at September 30, 2015, which indicates the Company

was in a net position of receiving cash under such swaps.

CRITICAL ACCOUNTING ESTIMATES AND POLICIES

The Company prepares its consolidated financial statements in conformity with accounting principles generally accepted in the

United States of America (U.S. GAAP). This requires management to make estimates and assumptions that affect reported amounts

and related disclosures. Actual results could differ from those estimates. The following policies are considered by management to

be the most critical in understanding the judgments that are involved in the preparation of the Company’s consolidated financial

statements and the uncertainties that could impact the Company’s results of operations, financial position and cash flows.

Revenue Recognition

The Company’s Building Efficiency business recognizes revenue from certain long-term contracts over the contractual period

under the percentage-of-completion (POC) method of accounting. This method of accounting recognizes sales and gross profit as

work is performed based on the relationship between actual costs incurred and total estimated costs at completion. Recognized

revenues that will not be billed under the terms of the contract until a later date are recorded primarily in accounts receivable.

Likewise, contracts where billings to date have exceeded recognized revenues are recorded primarily in other current liabilities.

Changes to the original estimates may be required during the life of the contract and such estimates are reviewed monthly. Sales

and gross profit are adjusted using the cumulative catch-up method for revisions in estimated total contract costs and contract

values. Estimated losses are recorded when identified. Claims against customers are recognized as revenue upon settlement. The

amount of accounts receivable due after one year is not significant. The use of the POC method of accounting involves considerable

use of estimates in determining revenues, costs and profits and in assigning the amounts to accounting periods. The periodic reviews

have not resulted in adjustments that were significant to the Company’s results of operations. The Company continually evaluates

all of the assumptions, risks and uncertainties inherent with the application of the POC method of accounting.

The Building Efficiency business enters into extended warranties and long-term service and maintenance agreements with certain

customers. For these arrangements, revenue is recognized on a straight-line basis over the respective contract term.

The Company’s Building Efficiency business also sells certain heating, ventilating and air conditioning (HVAC) and refrigeration

products and services in bundled arrangements, where multiple products and/or services are involved. In accordance with ASU

No. 2009-13, "Revenue Recognition (Topic 605): Multiple-Deliverable Revenue Arrangements - A Consensus of the FASB

Emerging Issues Task Force," the Company divides bundled arrangements into separate deliverables and revenue is allocated to

each deliverable based on the relative selling price method. Significant deliverables within these arrangements include equipment,

commissioning, service labor and extended warranties. In order to estimate relative selling price, market data and transfer price

studies are utilized. Approximately four to twelve months separate the timing of the first deliverable until the last piece of equipment

is delivered, and there may be extended warranty arrangements with duration of one to five years commencing upon the end of

the standard warranty period.

In all other cases, the Company recognizes revenue at the time title passes to the customer or as services are performed.