INTL FCStone 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and invested in building a global, multi-asset-class

infrastructure to best serve our growing client base.

This was an expensive and

time-consuming endeavor

that has certainly weighed

on our earnings over the

past few years, but we feel

we are now emerging as a

“best-in-class” mid-market

nancial franchise that has a

unique set of capabilities, well

placed to take advantage of a

continuing consolidation of the

industry. We believe that this

consolidation is still in its early

stages, and is being driven by

increased infrastructure costs

and capital requirements for

the smaller players rendering

them uneconomic, while the

larger banks have been focusing on their larger core

clients at the expense of the mid-sized clients we

seek to serve. Most clients we target are generally

looking to transact with fewer but better capitalized

entities that offer a well-rounded menu of services

and capabilities – a role for which we believe we are

eminently well suited.

We provide our 20,000 accounts with:

• Advice, specialized market intelligence and

insight to allow them to effectively utilize

markets to manage risks and/or enhance

returns

• Efcient execution by providing access to

global liquidity sources from exchanges to

Swap Execution Facilities (“SEF”) and over the

counter (“OTC”) counterparts

• Clearing and prime brokerage post-trade

services

We provide these services across asset classes,

including all commodity verticals; securities, including

equities and xed income; foreign exchange; and

select physical markets. In the provision of these

services, we provide access to a full product suite from

spot, futures and forwards to

options and highly structured

transactions designed around

our clients’ needs.

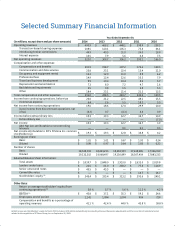

FINANCIAL RESULTS

We were encouraged to see

that our core Commercial

Hedging segment, which in the

past few scal years has been

negatively impacted by low

volatility, a North American

drought and turmoil in the

Futures Commission Merchant

(FCM) sector, began exhibiting

signs that it will perform at

a level consistent with our

expectations. Our exchange-

traded business was driven principally by improving

domestic agricultural markets as well as continued

volume growth in our London Metal Exchange (LME)

metals business, due in part to our expansion in Asian

markets.

The OTC volume growth was driven by increases

in energy and renewable fuels customer activity,

partially offset by a decline in hedging volumes in

Brazil. Deposits held on behalf of our commodity

customers, which is a source of interest income, also

increased 7% over FY2013 to $1.8 billion. However,

as in recent years, historically low short-term interest

rates have functioned as a signicant constraint on

our interest income from customer deposits.

Operating revenues in our Global Payments segment

experienced strong growth compared to the prior

scal year, which had also been a strong year for this

segment. Net operating revenues for this segment

reached $48.2 million, a 31% increase over the

previous year. This pattern of growth is attributable in

“Our common sense

approach has allowed

us to grow and prosper

as the nancial markets

have endured wrenching

change”