INTL FCStone 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chairman’s Letter

Following several years of market turmoil and uncertainty, the conclusion of

FY2014 has been marked by improved market conditions, relatively encouraging

nancial results, and a renewed spirit of optimism about our organization’s future

and the efcacy of our long-term business strategy.

Nevertheless, the prevailing macro trends of ever-

increasing regulations, close-to-zero interest rates and

drifting commodity markets continued to weigh on our

business as it has on others in our sector.

In an illuminating interview in the Wall Street Journal,

Andrew Haldane of the Bank of England noted that

the goal of current nancial-services regulations has

become “to capture every raindrop rather than look

out for the thunderstorms.” This increasingly byzantine

regulatory environment requires that nancial

services rms such as ours continue to expand their

regulatory and compliance capabilities. Indeed,

regulation and compliance has now developed some

of the aspects of a growth industry. For example, the

sourcing, hiring and retention of compliance staff has

become steadily more challenging over the past year,

and we often found ourselves competing not only with

other rms but, incredibly, with our own regulators for

qualied personnel.

On the commercial side, interest rates in the

developed world remained close-to-zero, and there

seems to be little immediate prospect of this changing,

as the burden of maintaining a rather anemic global

recovery and avoiding deation is borne wholly by the

monetary authorities. Thus, even though our average

customer deposits grew to USD $2 billion in the fourth

quarter, interest earnings remained marginal. In

addition, the weakness of all major economies with

the exception of the U.S. seems to portend that the

commodity markets will struggle for the next year.

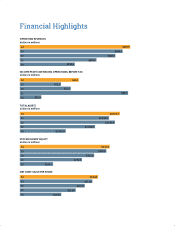

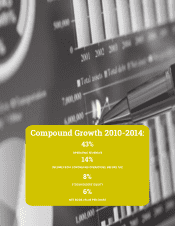

Despite these negative to neutral macro trends, I

am pleased to report your Company continued to

make progress, with operating revenues growing to

a record USD $490.9 million. This increase was driven

by strong revenue growth in our commercial hedging

and securities businesses. However, our star performer

was our global payments business, where revenues

increased by 35%. We also are encouraged by the

performance of our LME Metals business, which has

proven to be a strategically sound and remunerative

acquisition.

We continued to rene and restructure our

organization, and in 2014 completed the consolidation

of our U.K. subsidiaries into one nancial corporation

which can provide all nancial services to our client

base with the exception of deposit taking and fund

management. This has clear organizational benets

and also allows a more efcient use of our capital

resources.

Despite these achievements, our stock price in 2014

remained at levels approaching book value. As the

Company’s largest shareholders, your board is only too

well aware of this disappointing stock performance.

However, I am condent that, as our results continue

to improve, the market will begin to give a reasonable

valuation to a nancially stable, diversied and

growing nancial services company such as ours.

During the year, the board was expanded by the

appointment of Ed Grzybowski. Ed is an institutional

investor who served as chief investment ofcer of

TIAA-CREF, where he was responsible for investing

a portfolio of approximately half a trillion dollars

in assets. The condence displayed by such a

sophisticated investor in joining our team is, in my

view, a strong endorsement of our future growth and

prosperity.

In summary, 2014 was a year in which, despite difcult

market conditions, your Company delivered strong

internal growth, improved its organizational and

management structures and enhanced its competitive

position in an industry still recovering from the

shockwaves of the nancial crisis. I remain condent

these achievements will provide a strong basis for

continued growth in 2015 and thank our management

and employees for their continuing efforts and our

shareholders for their loyalty and support.

JOHN RADZIWILL

Non-Executive Chairman