INTL FCStone 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

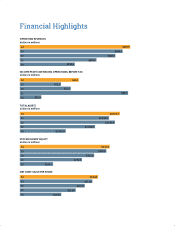

The Company earned $19.3 million on $322 million

of net operating revenues, and ended the year with

shareholders’ equity of $345 million. Net operating

revenues for our fourth quarter of 2014, as well as

the full scal year, established new records for the

company as well as for the Global Payments and

Securities segments.

Excluding the one-time gain in FY2013 of $9.2 million

($5.8 million after-tax) that was recognized from the

sale of our LME and Kansas City Board of Trade shares,

net operating revenues were up 7% and net income

from continuing operations were up 53%, while costs

were held to a modest 3% increase.

The Company’s

improved net operating

revenues were driven

by our largest segment,

Commercial Hedging, as

well as by strong growth

in our Global Payments

segment, which

increased 31%, and

continued growth in our

Securities business. The

Clearing and Execution

segment showed

slightly lower revenues,

although net segment

income increased as we

focused on margins and

costs in this business. Finally, net operating revenue

from Physical Commodities, which is our smallest

segment, declined as we restructured this business.

During the past year, we also continued to expand

our capabilities and range of services. Toward that

end, following the conclusion of the scal year,

we completed the acquisition of G.X. Clarke & Co.,

an institutional xed income business. The G.X.

Clarke team is experienced and well-respected, has

demonstrated expertise in this marketplace and

shares our philosophy of providing a value-added

service to clients. This acquisition rounds out our

securities product offering and also brings with it deep

relationships with more than 800 institutional clients,

many of whom may be interested in taking advantage

of our other capabilities.

OUR PHILOSOPHY

In 2003, the current management team recongured

the Company as a provider of nancial services

focused on underserved clients in niche markets.

From the outset, we have had to earn our way into

relationships by means of deep and specialized

knowledge of our clients’ markets, high-touch, value-

added service and a total, unwavering

commitment to serving our clients’

best interests. As we have continued

to grow, our client-rst philosophy and

culture has become deeply embedded

in all that we do. Please take the time

to read our Corporate Vision statement

on our website, which sets out the

deeply held values and principles that

we as an organization stand for.

Our common sense approach has

allowed us to grow and prosper as

the nancial markets have endured

wrenching change. From the original

group of less than 10 professionals

12 years ago, we now employ more

than 1,100 professionals serving some

20,000 accounts located in nearly every country across

the globe. Since the onset of the nancial crisis, many

of our competitors have disappeared or have had

to re-assess their outdated business models, while

others have chosen to retreat into a narrower product

offering as regulations became more complex and

costly to implement. The INTL FCStone management

team took a different route. We expanded our

capabilities; acquired attractive franchises that had

a similar client-focused philosophy and helped to

position us in key markets, products or verticals;

Chief Executive’s Report

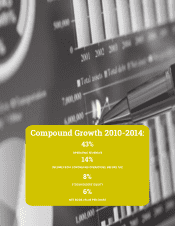

INTL FCStone’s performance in FY2014 was substantially improved at almost

every level over last year’s disappointing results.

“Operating revenues

for FY2014 and for our

fourth quarter established

records for the company”