INTL FCStone 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

large part to the continued acquisition of commercial

bank clients and the successful implementation of

a new back-ofce platform that now enables us to

process increased volumes, including smaller notional

payments, without the hiring of additional support

personnel.

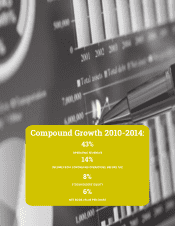

All product lines in our Securities business grew in

FY2014, driving net operating revenues up by 14%

over FY2013. Leading this growth were double-digit

increases in debt trading and asset management

revenues, resulting from favorable market conditions

both domestically and in South America.

Net operating revenues in our Clearing and Execution

Services (CES) segment declined $4.4 million versus

the previous year. However, our efforts to transform

this business yielded results as the bottom line

increased slightly as our

margins improved and

expenses declined.

Our overall nancial

performance was

negatively impacted by

a revenue decline in our

Physical Commodities

segment. This segment will

continue to be the focus

of renewed emphasis in

the coming scal year,

with the goal of realizing

improved results by the

end of the coming scal

year.

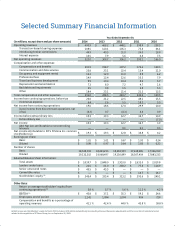

Our performance on the expense side of the equation

was relatively encouraging during the past scal

year, as our xed expenses declined 2%, or $3.1

million, compared to the previous year. This was

despite increasing expenses associated with growing

regulatory requirements and increased data costs

from exchanges. Variable expenses were 56% of total

expenses in FY2014, which was a slight improvement

over the previous year. Total non-variable expenses,

which include xed expenses as well as bad debts and

impairments, increased 1% to $202.1 million in FY2014.

The past scal year also marked the completion of

the consolidation of our U.K. subsidiaries, forming

one nancial services rm permitted to provide all

nancial services with the exception of deposit-

taking and fund management; and the initiation of

a similar process to consolidate our North American

subsidiaries, a process that will continue through the

coming scal year. This consolidation will allow us

to provide all of our products more seamlessly to our

growing client base as well as leverage our capital

and infrastructure more effectively and efciently.

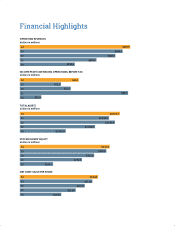

We concluded FY2014 in a strong nancial position,

aided in good measure by the

restructuring of our bank facilities

and the issuance of senior notes in

the previous year. We ended the

current scal year with $22.5 million

in outstanding borrowings versus

$270 million in committed facilities.

Total assets were at $3.04 billion at

the end of the FY2014, a 7% increase

over the prior year.

Shareholders’ equity continued to

trend upward compared to previous

years, and reached $345.4 million

at the end of the scal year. Our net

income attributable to INTL FCStone

common stockholders reached $19.3

million, a slight increase over the previous scal year,

and book value per outstanding share also increased

to $18.29.

As discussed in the Selected Financial Data section

of this Report, our Return on Equity, though slightly

improved at 6% over FY2013, still falls short of our

Chief Executive’s Report cont’d.

“We concluded FY2014 in

a strong nancial position”