Huntington National Bank 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

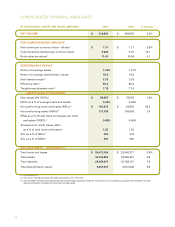

2005 HIGHLIGHTS

In this annual report, you will fi nd a detailed review of our 2005 performance, and I encourage you to take the time

to read our discussion. But here are some fi nancial highlights:

_ $1.77 earnings per common share, up 4% and a new record.

_ 16.0% return on average equity.

_ 11% growth in average total consumer loans and leases… 27% growth in residential loans and 11% growth in home

equity loans and lines.

_ 8% growth in average total commercial loans and leases… 8% growth in middle market commercial loans, 7%

growth in middle market commercial real estate loans, and 11% growth in small business loans.

_ 5% growth in average total core deposits.

_ 57% expense effi ciency ratio in the 2005 fourth quarter, down from 66% in the year-earlier quarter.

_ Good credit quality performance including… 0.33% net charge-off ratio, 0.48% year-end non-performing asset

ratio, and 261% year-end credit loss reserve to non-performing asset ratio.

_ 14.5% increase in cash dividends paid.

_ Repurchased 9.6 million, or 4%, of our December 31, 2004 shares outstanding.

While last year’s total return for the S&P 500, including reinvested dividends, was a positive 4.9%, it was a diffi cult

year for bank investors. Our stock ended the year at $23.75, down 4%. Even with the benefi t of reinvested dividends,

our total return for shareholders was still a negative 0.5%. Yet this was better than the negative 1.4% total return for

the S&P Regional Bank Index.

Other accomplishments included technology investments in Business Online banking, enhanced banking offi ce

capabilities, and loan decisioning systems. We opened four new banking offi ces and relocated two others. We signed

ATM partnership agreements with CVS Pharmacy and Walgreens, adding more than 200 ATMs to our network.

The performance of our Private Financial and Capital Markets area was most noteworthy. Trust assets and brokerage

assets grew 7% and 9%, respectively. Assets under management grew 10%, including 13% growth in the Huntington

Funds, refl ecting their outstanding performance. Four of our nine equity funds received Morningstar “4 Star” ratings,

and one fi xed income fund was rated “5 Star.”

SEC FORMAL INVESTIGATION AND

FORMAL REGULATORY SUPERVISORY AGREEMENTS

On June 2, 2005, we announced that the Securities and Exchange Commission approved the settlement of its formal

investigation into certain accounting matters. On October 6, 2005, we announced that the Comptroller of the Currency

lifted its formal written agreement with Huntington National Bank dated earlier in the year. While the formal written

agreement with the Federal Reserve Board remains in effect, we are confi dent that we will be able to address compre-

hensively all of the issues raised to their full satisfaction.

I want to assure you that Huntington is now stronger in the areas of accounting policy, internal audit, regulatory

reporting, risk management, and corporate governance. The board of directors and your management team are

strongly committed to assuring that the highest of ethical standards are followed. We are also fully committed to

full, fair and transparent fi nancial disclosure and to assure that our policies and practices in these areas meet all

best-in-class standards.

4