Huntington National Bank 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THOMAS E. HOAGLIN Chairman, President and Chief Executive Officer

TO OUR SHAREHOLDERS AND FRIENDS:

February marks my fi fth anniversary as your chief executive offi cer, so I

wanted to begin this year’s letter by refl ecting on all that has happened at

Huntington during the past fi ve years. There have been signifi cant changes,

progress, and success in a number of areas. There also remain challenges

and opportunities. Above all, I want you to understand clearly what we are

trying to accomplish at Huntington.

2

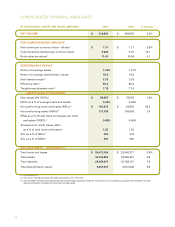

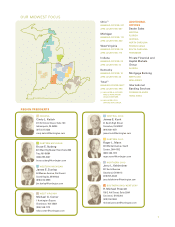

5-YEAR REVIEW

In July 2001, we decided to sell our Florida banking operations. The sale allowed us to strengthen our low relative

capital levels and return value to shareholders by using the freed-up capital to repurchase Huntington shares.

Concurrently, we decided to focus our efforts on the Midwest markets we knew well, where we could realize higher

returns on capital.

We adopted a business model that emphasizes decision-making in local markets by empowered local bankers. Together

with an array of sophisticated products and services, this model enables Huntington to be viewed as “the local bank

with national resources.”

We strengthened our leadership team in our banking regions and corporate staff functions. Our well-seasoned team

is energized and capable of leading Huntington to our goal of becoming a high performing fi nancial services company.

We have made numerous investments to improve customer service. State-of-the-art banking offi ce platform technology

is now in place, giving Huntington associates more comprehensive information to use in serving customers better.

We opened 18 new banking offi ces in growing markets and consolidated others to gain effi ciencies of scale. We also

installed a disciplined sales process to help associates deepen customer relationships.

Changing to a culture of empowerment and customer focus has not been easy. But associates have responded well to

encouragement that they “go ahead” and make decisions on behalf of customers. We continue to improve every day

and customers are seeing and experiencing a difference. At the end of 2005, 36% of our consumer households utilize

four or more services, up from 31% at the end of 2003. Similarly, 15% of our small business customers use four or

more services, up from 10%.