Harley Davidson 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

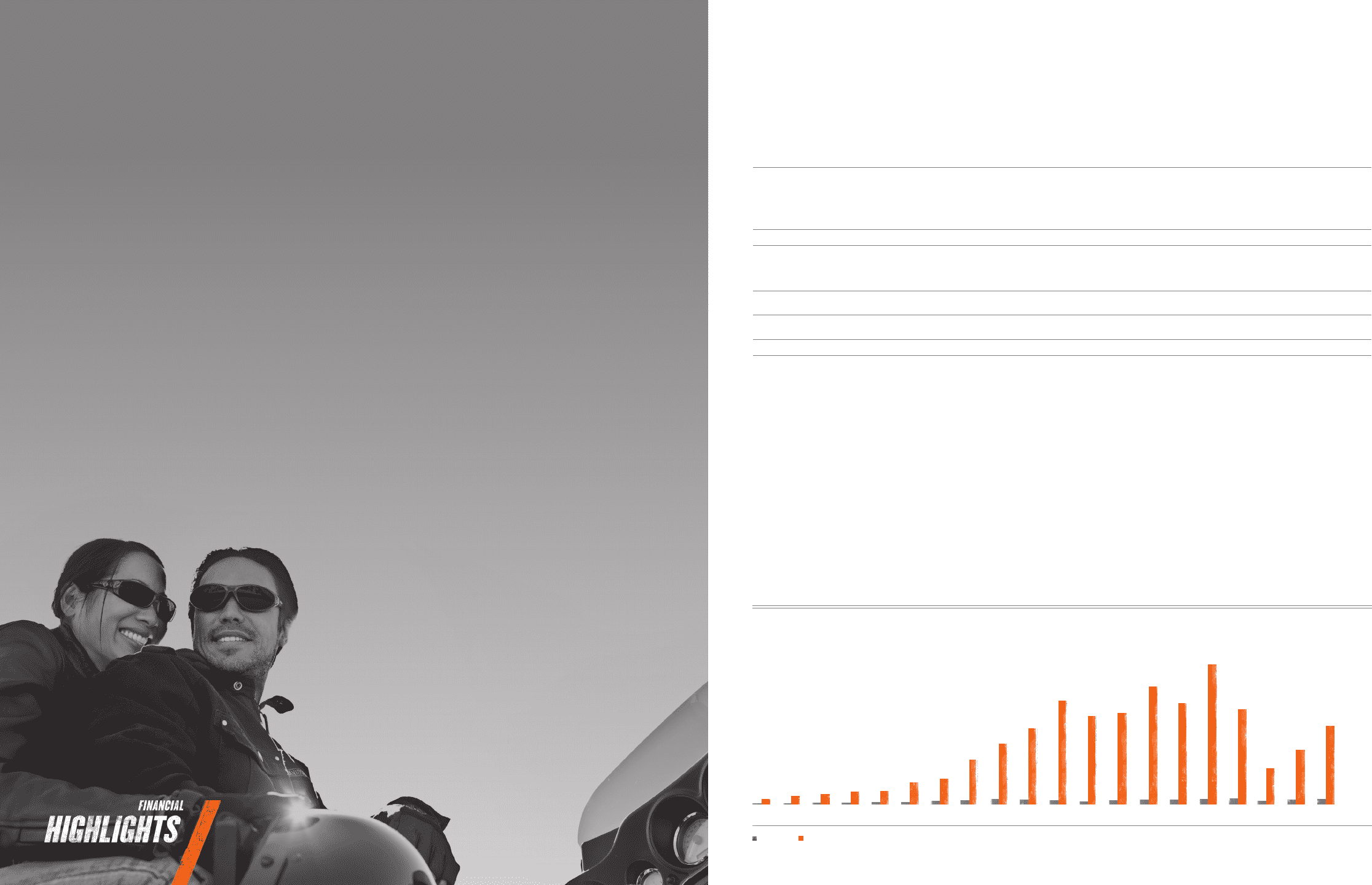

Financial Performance Summary

In 2010, Harley-Davidson’s revenue from motorcycles and related

products on a continuing operations basis decreased 2.6 percent

to $4.18 billion compared to 2009, and income from continuing

operations increased 267.6 percent from the prior year to $259.7

million. These results reect improved operating margin

for the Company’s motorcycle business, strong operating income

at Harley-Davidson Financial Services and the impact of

restructuring charges and a 2010 debt repurchase.

Revenue from sales of Harley-Davidson motorcycles decreased

to $3.14 billion in 2010, a decline of 1.2 percent from 2009,

on a 5.6 percent reduction in shipments of Harley-Davidson

motorcycles. Revenue from Genuine Parts and Accessories

in 2010 totaled $749.2 million, a 2.4 percent decrease from the

previous year, and General Merchandise revenue was $259.1

million, a decrease of 8.2 percent compared to 2009.

During 2010, Harley-Davidson took actions to lower its cost

structure through eliminating excess capacity, reducing

administrative costs and exiting non-core business operations.

Harley-Davidson expects restructuring activities announced

since 2009, including those announced in early 2011 related to

Kansas City Vehicle Operations, to deliver between $305 million

and $325 million in annual ongoing savings upon completion

of those restructuring activities.

Harley-Davidson’s share price increased 37.6 percent during

2010 and the Company paid out dividends of $.40 per share in 2010.

Harley-Davidson has paid a dividend every year since 1993.

Harley-Davidson Motorcycles

Worldwide retail sales of Harley-Davidson motorcycles declined

8.5 percent in 2010 compared to 2009.

In the United States, 2010 retail sales of 143,391 Harley-Davidson

motorcycles decreased 11.7 percent from 2009 and overall U.S.

heavyweight market registrations declined 14.6 percent. For the full

year 2010, retail sales of Harley-Davidson motorcycles in our

international markets decreased 1.9 percent compared to 2009.

For the same period, retail sales of Harley-Davidson motorcycles

increased 3.0 percent in the Europe Region and 5.4 percent in

the Latin America Region, and decreased 9.0 percent in Canada

and 8.7 percent in the Asia Pacic Region.

In 2010, the Company shipped 210,494 Harley-Davidson motor-

cycles worldwide, compared to 223,023 in 2009. In 2010,

37.5 percent of the Harley-Davidson motorcycles shipped went

to international markets compared to 35.2 percent in 2009.

Harley-Davidson Financial Services

Financial Services recorded operating income of $181.9 million in

2010 compared to an operating loss of $118.0 million in 2009.

HDFS’ business benetted from a lower cost of funds and improved

credit performance compared to last year.

In thousands, except per-share amounts 2010 2009 2008

Statement of Operations Data:

Motorcycles and related products revenue $ 4,176,627 $ 4,287,130 $ 5,578,414

Gross profit 1,427,403 1,386,196 1,931,144

Selling, administrative and engineering expense 885,137 851,165 942,267

Restructuring expense and other impairments 163,508 220,976 12,475

Operating income from motorcycles & related products 378,758 314,055 976,402

Financial services revenue 682,709 494,779 376,970

Financial services expense 500,836 581,059 294,205

Restructuring expense – 3,302 –

Goodwill impairment – 28,387 –

Operating income (loss) from nancial services 181,873 (117,969) 82,765

Operating income 560,631 196,086 1,059,167

Investment income 5,442 4,254 11,296

Interest expense 90,357 21,680 4,542

Loss on debt extinguishment 85,247 – –

Income before provision for income taxes 390,469 178,660 1,065,921

Provision for income taxes 130,800 108,019 381,686

Income from continuing operations 259,669 70,641 684,235

Loss from discontinued operations, net of tax (113,124) (125,757) (29,517)

Net income (loss) $ 146,545 $ (55,116) $ 654,718

Earnings per common share from continuing operations:

Basic $ 1.11 $ 0.30 $ 2.92

Diluted $ 1.11 $ 0.30 $ 2.92

Loss per common share from discontinued operations:

Basic $ (0.48) $ (0.54) $ (0.13)

Diluted $ (0.48) $ (0.54) $ (0.13)

Earnings (loss) per common share:

Basic $ 0.63 $ (0.24) $ 2.80

Diluted $ 0.62 $ (0.24) $ 2.79

Weighted-average common shares:

Basic 233,312 232,577 234,225

Diluted 234,787 233,573 234,477

Cash dividends per common share $ 0.40 $ 0.40 $ 1.29

Consolidated Balance Sheet Data (at December 31):

Total assets $ 9,430,740 $ 9,155,518 $ 7,828,625

Total debt $ 5,752,356 $ 5,636,129 $ 3,914,887

Total equity $ 2,206,866 $ 2,108,118 $ 2,115,603

25,000

20,000

15,000

10,000

5,000

0

999897969594939291 0605040200 01 03 07 08

204

852

220

1,433

242

1,686

245

2,152

337

2,224

414

3,650

553

4,257

710

7,434

860

10,084

782

12,544

689

17,169

537

14,645

690

15,133

766

19,476

803

16,709

930

23,191

981

15,687

618

5,956

09

782

9,061

10

899

12,641

Harley-Davidson, Inc. vs. Standard & Poor’s 500 Composite Index

In dollars

30 Financial Highlights 31

S&P 500 Comparison of year-end value of $100 invested Dec. 31, 1986 (20 Years Shown). Assumes for both Harley-Davidson and S&P that all dividends are reinvested.H-D

Harley-Davidson, Inc. 2010 Annual Report