Freddie Mac 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Freddie Mac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART I

Throughout PART I of this Form 10-K, we use certain acronyms and terms which are defined in the Glossary.

ITEM 1. BUSINESS

Our Business and Statutory Mission

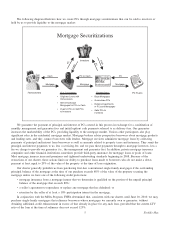

Freddie Mac was chartered by Congress in 1970 with a public mission to stabilize the nation’s residential mortgage

markets and expand opportunities for home ownership and affordable rental housing. Our statutory mission is to provide

liquidity, stability and affordability to the U.S. housing market. Our participation in the secondary mortgage market includes

providing our credit guarantee for residential mortgages originated by mortgage lenders and investing in mortgage loans and

mortgage-related securities. Through our credit guarantee activities, we securitize mortgage loans by issuing PCs to third-

party investors. We also resecuritize mortgage-related securities that are issued by us or Ginnie Mae as well as private, or

non-agency, entities by issuing Structured Securities to third-party investors. We guarantee multifamily mortgage loans that

support housing revenue bonds issued by third parties and we guarantee other mortgage loans held by third parties.

Securitized mortgage-related assets that back PCs and Structured Securities that are held by third parties are not reflected as

assets on our consolidated balance sheets in this Form 10-K. However, effective January 1, 2010, we will prospectively

recognize on our consolidated balance sheets the mortgage loans underlying our issued single-family PCs and certain

Structured Transactions as mortgage loans held-for investment by consolidated trusts, at amortized cost. Correspondingly, we

will also prospectively recognize single-family PCs and certain Structured Transactions held by third parties on our

consolidated balance sheets as debt securities of consolidated trusts held by third parties. See “NOTE 1: SUMMARY OF

SIGNIFICANT ACCOUNTING POLICIES — Recently Issued Accounting Standards, Not Yet Adopted Within These

Consolidated Financial Statements — Accounting for Transfers of Financial Assets and Consolidation of VIEs” to our

consolidated financial statements for additional information regarding these changes and a description of how these changes

are expected to impact our results and financial statement presentation.

We earn management and guarantee fees for providing our guarantee and performing management activities (such as

ongoing trustee services, administration of pass-through amounts, paying agent services, tax reporting and other required

services) with respect to issued PCs and Structured Securities.

We are focused on meeting the urgent liquidity needs of the U.S. residential mortgage market, lowering costs for

borrowers and supporting the recovery of the housing market and U.S. economy. By continuing to provide access to funding

for mortgage originators and, indirectly, for mortgage borrowers, and through our role in the Obama Administration’s

initiatives, including the MHA Program, we are working to meet the needs of the mortgage market by making home

ownership and rental housing more affordable, reducing the number of foreclosures and helping families keep their homes.

For more information, see “MD&A — EXECUTIVE SUMMARY — MHA Program.”

Conservatorship

We continue to operate under the direction of FHFA as our Conservator. We are subject to certain constraints on our

business activities by Treasury due to the terms of, and Treasury’s rights under, our Purchase Agreement with Treasury. The

conservatorship and related developments have had a wide-ranging impact on us, including our regulatory supervision,

management, business, financial condition and results of operations. There is significant uncertainty as to whether or when

we will emerge from conservatorship, as it has no specified termination date, and as to what changes may occur to our

business structure during or following our conservatorship, including whether we will continue to exist. Our future structure

and role are currently being considered by the President and Congress. We have no ability to predict the outcome of these

deliberations. However, we are not aware of any immediate plans of our Conservator to significantly change our business

structure in the near-term. For information on the conservatorship and the Purchase Agreement, see “Conservatorship and

Related Developments.”

Our business objectives and strategies have in some cases been altered since we were placed into conservatorship, and

may continue to change. Based on our charter, public statements from Treasury and FHFA officials and guidance from our

Conservator, we have a variety of different, and potentially competing, objectives. Certain changes to our business objectives

and strategies are designed to provide support for the mortgage market in a manner that serves our public mission and other

non-financial objectives. In this regard, we are focused on serving our mission, helping families keep their homes and

stabilizing the economy by playing a vital role in the Obama Administration’s housing programs. However, these changes to

our business objectives and strategies may not contribute to our profitability. Some of these changes increase our expenses,

while others require us to forego revenue opportunities in the near-term. In addition, the objectives set forth for us under our

charter and by our Conservator, as well as the restrictions on our business under the Purchase Agreement, may adversely

impact our financial results, including our segment results. For example, our current business objectives reflect, in part,

direction given us by the Conservator. These efforts are expected to help homeowners and the mortgage market and may help

1Freddie Mac