Experian 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

Annual report on remuneration continued

Dividend equivalents of 97.25 cents per share will be paid on vested shares. These represent the value of the dividends that would

have been paid to the owner of one Company share between the date of grant and the date of vesting.

Don Robert and Chris Callero will therefore receive dividend equivalent cash sums of US$616,707 and US$395,267 respectively, on

the vesting of the shares on 15 June 2014.

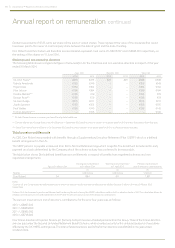

Chairman and non-executive directors

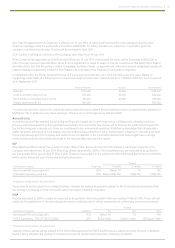

The following table shows a single total figure of remuneration for the Chairman and non-executive directors in respect of the year

ended 31 March 2014.

Fees ‘000 Benefits ‘000 Total ‘000

2014 2013 2014 2013 2014 2013

Sir John Peace* £375 £375 £23 £23 £398 £398

Fabiola Arredondo €153 €149 – – €153 €149

Roger Davis €164 €164 – – €164 €164

Alan Jebson €196 €184 – – €196 €184

Deirdre Mahlan** €135 €79 – – €135 €79

George Rose** €135 €79 – – €135 €79

Sir Alan Rudge €215 €217 – – €215 €217

Judith Sprieser €153 €155 – – €153 €155

Paul Walker €135 €143 – – €135 €143

Former directors*** –€106 – – – €106

* Sir John Peace receives a company car benefit and private healthcare.

** Deirdre Mahlan and George Rose joined the Board on 1 September 2012 and the amounts shown in the above table for 2013 are their fees earned from that date.

*** David Tyler retired from the Board on 31 December 2012 and the amount shown in the above table for 2013 is his fees earned to that date.

Total pension entitlements

As CEO, Don Robert was provided with benefits through a Supplementary Executive Retirement Plan (‘SERP’) which is a defined

benefit arrangement in the US.

The SERP pension is payable unreduced from Don’s Normal Retirement Age which is age 60. The benefit will be reduced for early

payment on a basis determined by the Company which the scheme actuary has confirmed to be reasonable.

The table below shows Don’s defined benefit pension entitlements in respect of benefits from registered schemes and non-

registered arrangements.

Name

Age at 31 March 2014

Closing accrued pension

at 31 March 2014

Opening accrued pension

at 1 April 2013

Pension input amount

(net of director’s contributions)

(1) (2) (3)

US$’000 pa US$’000 pa US$’000

Don Robert 54 684 611 1,187

Notes

Columns (1) and (2) represent the deferred pension to which the director would have been entitled had he left the Group at 31 March 2014 and 31 March 2013

respectively.

Column (3) is the increase in pension entitlement built up during the period using the HMRC calculation method (with a valuation factor of 20). The calculation allows for

inflation over the period in line with September 2013 CPI and the amount shown is net of the director’s contributions.

The pension input amount (net of director’s contributions) for the prior four years was as follows:

2013 : US$ 807,000

2012 : US$ 869,000

2011 : US$ 952,0 00

2010 : US$726,0 00

Four former directors of Experian Finance plc (formerly GUS plc) receive unfunded pensions from the Group. Three of the former directors

are now paid under the Secured Unfunded Retirement Benefit Scheme, which provides security for the unfunded pensions of executives

affected by the UK HMRC earnings cap. The total unfunded pensions paid to the former directors was £390,000 in the year ended

31 March 2014.

Governance • Report on directors’ remuneration