Experian 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements • Notes to the Group financial statements

Notes to the Group financial statements

for the year ended 31 March 2014 continued

128

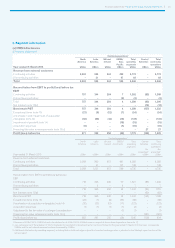

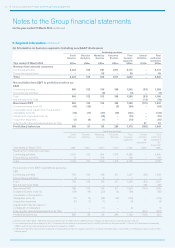

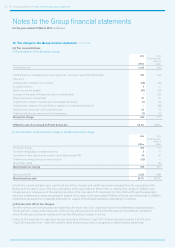

15. Net finance costs

(a) Net finance costs included in Profit before tax

2014

US$m

2013

(Re-presented)

(Note 3)

US$m

Interest income:

Bank deposits, short-term investments and loan notes (20) (16)

Interest on opening retirement benefit assets (2) (4)

Interest income (22) (20)

Finance expense:

Bank loans and overdrafts 14 6

Eurobonds and notes 103 103

Commitment and facility fees 10 10

Interest differentials on derivatives (31) (37)

Interest expense 96 82

(Credit)/charge in respect of financing fair value remeasurements (note 15(c)) (27) 561

Finance expense 69 643

Net finance costs included in Profit before tax 47 623

(b) Net interest expense included in Benchmark PBT

2014

US$m

2013

(Re-presented)

(Note 3)

US$m

Interest income (22) (20)

Interest expense 96 82

Net interest expense included in Benchmark PBT 74 62

(c) Analysis of (credit)/charge in respect of financing fair value remeasurements

2014

US$m

2013

US$m

Fair value (gains)/losses on borrowings – attributable to interest rate risk (61) 32

Fair value losses/(gains) on borrowings – attributable to currency risk 121 (60)

Losses on interest rate swaps – fair value hedges 15 12

(Gains)/losses on cross currency swaps – fair value hedges (73) 9

Fair value (gains)/losses on non-hedging derivatives (36) 10

Foreign exchange losses/(gains) on financing activities 19 (5)

Increase in fair value of Serasa put option – 558

(Decrease)/increase in fair value of other options (12) 5

(Credit)/charge in respect of financing fair value remeasurements (27) 561

The charge of US$558m in the year ended 31 March 2013 for the increase in the fair value of the Serasa put option reflected

the movement to the date of the acquisition of the additional 29.6% interest in Serasa in November 2012 and the terms of the

related agreement. As the option lapsed on the acquisition of the further interest, there is no such charge in the year ended

31 March 2014.