Experian 2014 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178

|

|

Financial statements • Notes to the Group financial statements 139

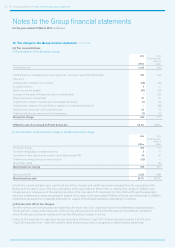

24. Cash and cash equivalents

(a) Analysis of cash and cash equivalents by nature

2014

US$m

2013

US$m

Cash at bank and in hand 91 139

Short-term investments 121 90

212 229

The effective interest rate for cash and cash equivalents at 31 March 2014 is 6.2% (2013: 3.7%). There is no material difference

between the fair value of cash and cash equivalents and the book value stated above.

(b) Analysis of cash and cash equivalents by external credit rating

2014

US$m

2013

US$m

Counterparty holding of more than US$2m:

A rated 113 125

B rated 68 79

Non-rated 8 –

Counterparty holding of more than US$2m 189 204

Counterparty holding of less than US$2m 23 25

212 229

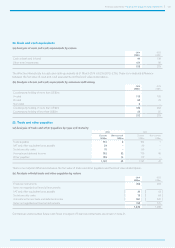

25. Trade and other payables

(a) Analysis of trade and other payables by type and maturity

2014 2013

Current

US$m

Non-current

US$m

Current

US$m

Non-current

US$m

Trade payables 153 6 184 1

VAT and other equivalent taxes payable 39 – 43 –

Social security costs 78 – 85 –

Accruals and deferred income 792 32 773 40

Other payables 106 14 112 –

1,168 52 1,197 41

There is no material difference between the fair value of trade and other payables and the book value stated above.

(b) Analysis of total trade and other payables by nature

2014

US$m

2013

US$m

Financial instruments 452 463

Items not regarded as financial instruments:

VAT and other equivalent taxes payable 39 43

Social security costs 78 85

Amounts within accruals and deferred income 651 647

Items not regarded as financial instruments 768 775

1,220 1,238

Contractual undiscounted future cash flows in respect of financial instruments are shown in note 31.