Experian 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our differentiators

Products and services that generate

social and commercial value

Each year Experian helps millions

of organisations manage credit risk,

prevent fraud, target their marketing

and make their decision-making more

accurate and efficient. By building

social benefit more deliberately into our

mainstream business and utilising our

unique insights, we have the potential

to make a significant difference.

We have over a thousand existing

products and services and have identified

that many have an inherent social, as

well as a commercial benefit. With

an emphasis on how they can foster

financial inclusion, promote financial

education, and support small business

entrepreneurs, an initial assessment

undertaken during the last year

established that the social reach of just

30 of these products is around ten million

people a year.

For example, in Kenya, Ghana, Ivory

Coast and the Philippines we are enabling

better, cheaper access to finance through

branchless banking in emerging markets.

In the UK, our product, created with

Big Issue Invest, has the potential to

help one million social housing tenants

improve their credit reports and access

mainstream lending.

We will continue to evaluate our products

and examine how they can be replicated

in new regions, particularly in emerging

markets, benefiting those most vulnerable

in society.

Our aim over the last year was to scale

up our investment in social innovation –

products with a social purpose as their

starting point – to help us positively

impact an even greater number of

people. In achieving this aim, during

2013, we invested nearly US$700,000 to

develop new concepts and products.

Our employees provided a number

of ideas with a wide range of social

benefits and innovative business models.

Of the seven we funded following a

comprehensive assessment phase, the

benefits for individuals ranged from

a free online debt resolution service

in Brazil to improved provision for

children with special educational needs

in North America. The case studies

above describe the new services being

developed in India and Brazil.

Our goal is that these new data and

analytics products will create social

benefit for an additional five million

individuals, both consumers and

entrepreneurs, by 2018 around the world.

Helping consumers to make informed

and responsible decisions

Experian operates 19 consumer

bureaux across the world, reaching

millions of consumers. We are obliged

by law to provide a certain level of

service to consumers. We aim to

exceed imposed standards and have

a network of consumer champions

across the globe to help us do this.

We are continually investing in new ways

to improve our service and the information

we provide to consumers. This includes

in new markets where credit agencies

have not previously existed. Following the

opening of Experian’s Consumer Credit

Bureau in Australia, we launched our

Fraud Bureau in November 2013,

which enables data sharing with

credit providers before fraud occurs.

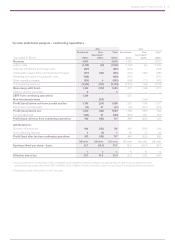

Community investment

2014

US$'000s

2013

US$'000s

Funds from Experian plc 2,299 1,217

Financial donations and investments

from Experian subsidiaries 2,347 2,676

Employee time volunteered 1,056 656

Gifts in kind 604 323

Management costs 605 416

Total from Experian 6,911 5,288

As % of Benchmark PBT 0.56% 0.44%

Employee fundraising 1,270 785

Total value of all giving 8,181 6,073

As % of Benchmark PBT 0.66% 0.51%

Increase in total community

investment from Experian of 31%.

Our corporate responsibilities continued

“ Experian’s programme of

investment in social innovation

is beginning to create true shared

value. This, combined with their

ambition to assess the social

impact of mainstream products,

really identifies them as one of the

originators in inclusive business.

They have set out a pioneering

approach and engaged their senior

leadership in its development

– a company to watch!”

Strategic report • Our corporate responsibilities56