Electronic Arts 2002 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2002 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

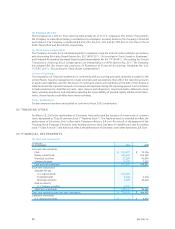

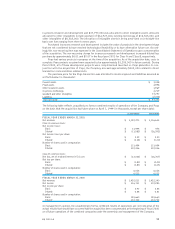

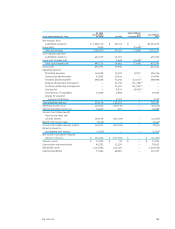

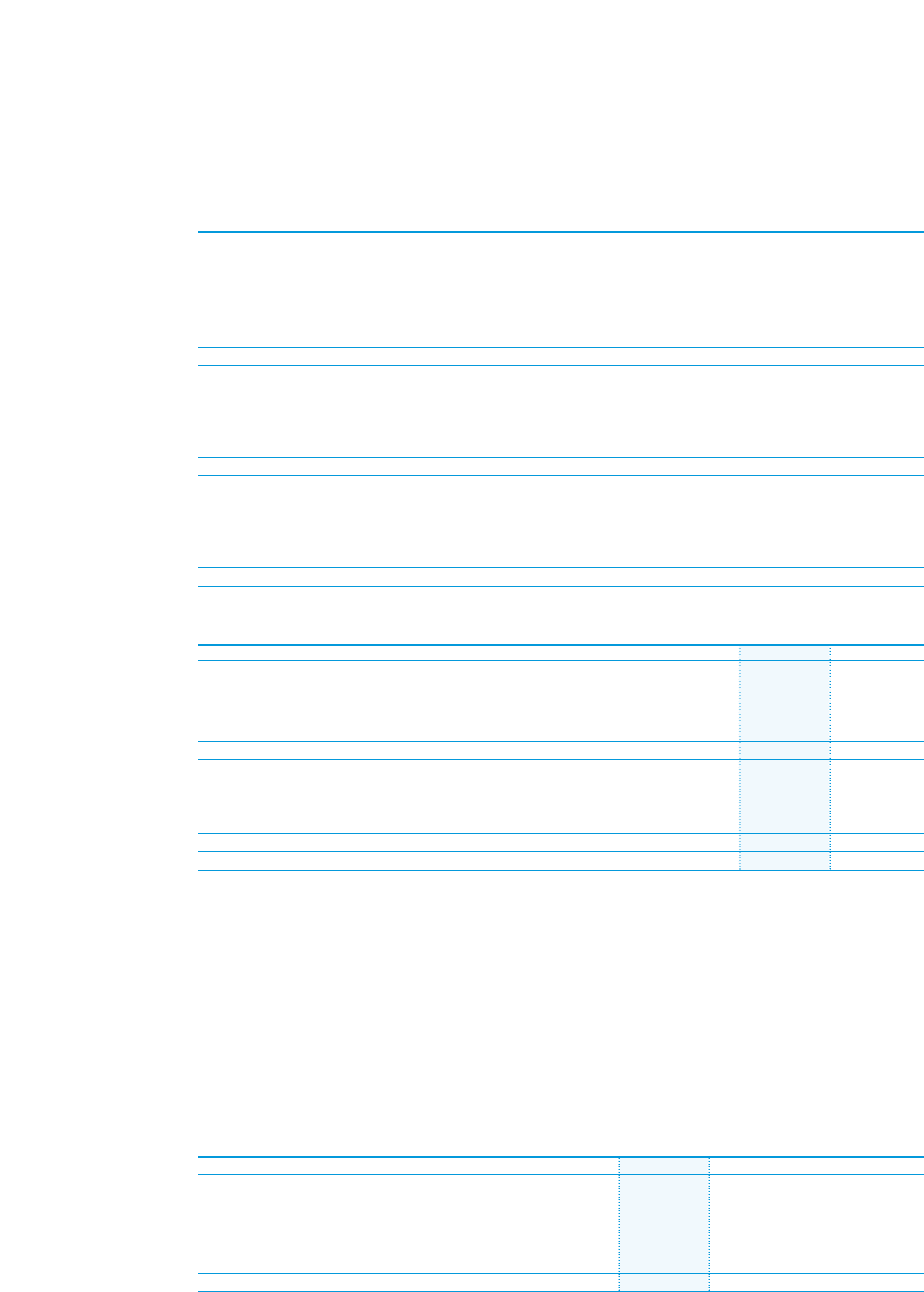

Income tax expense (benefit) for the fiscal years ended March 31, 2002, 2001 and 2000 consisted of:

(In thousands) CURRENT DEFERRED TOTAL

2002:

Federal$60,728 $ (44,277) $ 16,451

State 1,048 (672) 376

Foreign 4,306 2,295 6,601

Charge in lieu of taxes from employee stock plans for Class A 22,541 — 22,541

$88,623 $ (42,654) $ 45,969

2001:

Federal$(4,233) $ (19,975) $ (24,208)

State 582 (13,809) (13,227)

Foreign 6,981 541 7,522

Charge in lieu of taxes from employee stock plans for Class A 25,750 — 25,750

$29,080 $ (33,243) $ (4,163)

2000:

Federal$2,766 $ 3,231 $ 5,997

State 299 859 1,158

Foreign 15,573 (2,649) 12,924

Charge in lieu of taxes from employee stock plans 32,563 — 32,563

$51,201 $ 1,441 $ 52,642

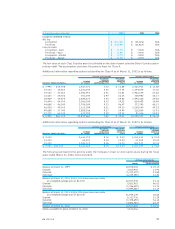

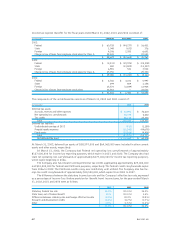

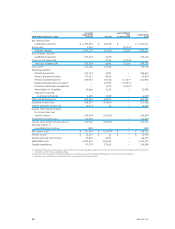

The components of the net deferred tax assets as of March 31, 2002 and 2001 consist of:

(In thousands) 2002 2001

Deferred tax assets:

Accruals, reserves and other expenses $53,891 $76,603

Net operating loss carryforwards 50,174 6,662

Tax credits 46,118 27,066

Total 150,183 110,331

Deferred tax liabilities:

Undistributed earnings of DISC (913) (1,189)

Prepaid royalty expenses (11,342) (44,678)

Fixed assets (35,266) (4,456)

Total (47,521) (50,323)

Net deferred tax asset $102,662 $60,008

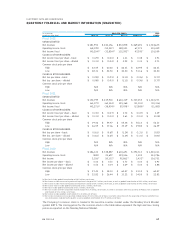

At March 31, 2002, deferred tax assets of $38,597,000 and $64,065,000 were included in other current

assets and other assets, respectively.

At March 31, 2002, the Company had Federal net operating loss carryforwards of approximately

$127,000,000 for income tax reporting purposes, which expire in 2021 and 2022.The Company also had

state net operating loss carryforwards of approximately $177,000,000 for income tax reporting purposes,

which expire beginning in 2006.

The Company also has research and experimental tax credits aggregating approximately $25,000,000

and $10,000,000 for federal and California purposes, respectively.The federal credit carryforwards expire

from 2006 to 2022.The California credits carry over indefinitely until utilized.The Company also has for-

eign tax credit carryforwards of approximately $10,500,000, which expire from 2003 to 2007.

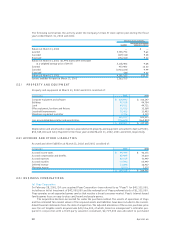

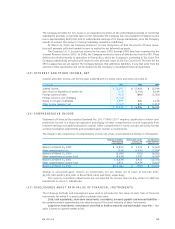

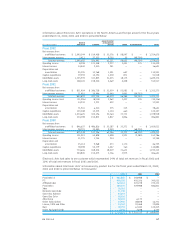

The differences between the statutory income tax rate and the Company’s effective tax rate, expressed

as a percentage of income (loss) before provision for (benefit from) income taxes, for the years ended March

31, 2002, 2001 and 2000 were as follows:

2002 2001 2000

Statutory Federal tax rate 35.0% (35.0%) 35.0%

State taxes, net of Federal benefit 1.5% (10.0%) 1.5%

Differences between statutory rate and foreign effective tax rate (3.0%) 20.2% (2.8%)

Research and development credits (3.4%) (4.7%) (1.7%)

Other 0.9% (1.5%) (1.0%)

31.0% (31.0%) 31.0%

EA 2002 AR

62