Electronic Arts 2002 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2002 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

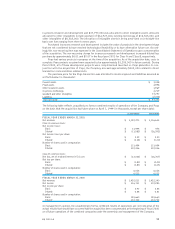

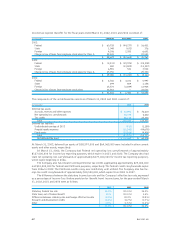

(4) LEASE COMMITMENTS

The Company leases certain of its current facilities and certain equipment under non-cancelable capital and

operating lease agreements.The Company is required to pay property taxes, insurance and normal mainte-

nance costs for certain of its facilities and will be required to pay any increases over the base year of these

expenses on the remainder of the Company’s facilities.

In February of 1995, the Company entered into a build-to-suit lease with a financial institution on its

headquarter’s facility in Redwood City, California, which was extended in July of 2001 and runs through July

of 2006.The Company accounted for this arrangement as an operating lease in accordance with Statement

of Financial Accounting Standards No. 13 (“SFAS 13”),

“Accounting for Leases”

,as amended. Existing

campus facilities developed in phase one comprise a total of 350,000 square feet and provide space for sales,

marketing, administration and research and development functions.The Company has an option to purchase

the property (land and facilities) for $145,000,000 or, at the end of the lease, to arrange for (1) an addi-

tional extension of the lease or (2) sale of the property to a third party with the Company retaining an

obligation to the owner for the difference between the sale price and the guaranteed residual value of up to

$128,900,000 if the sales price is less than this amount, subject to certain provisions of the lease.

In December 2000, the Company entered into a second build-to-suit lease with a financial institution for

a five year term from December 2000 to expand its headquarter’s facilities and develop adjacent property

adding approximately 310,000 square feet to its campus.The Company expects to complete construction in

June of 2002.The Company accounted for this arrangement as an operating lease in accordance with SFAS

13, as amended.The facilities will provide space for marketing, sales and research and development.The

Company has an option to purchase the property for $127,000,000 or, at the end of the lease, to arrange for

(1) an extension of the lease or (2) sale of the property to a third party with the Company retaining an oblig-

ation to the owner for the difference between the sale price and the guaranteed residual value of up to

$118,800,000 if the sales price is less than this amount, subject to certain provisions of the lease.

Lease rates are based upon the Commercial Paper Rate.The two lease agreements described above

require the Company to maintain certain financial covenants, all of which the Company was in compliance

with as of March 31, 2002.

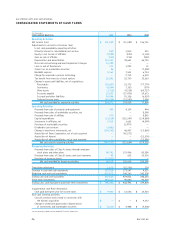

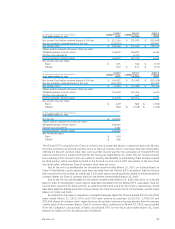

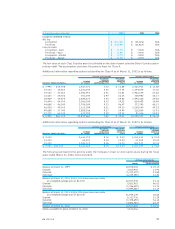

Total future minimum lease commitments as of March 31, 2002 are:

(In thousands) YEAR ENDED MARCH 31,

2003 $ 18,288

2004 15,011

2005 11,354

2006 10,810

2007 9,122

Thereafter 11,609

$76,194

Total rent expense for all operating leases was $25,177,000, $27,526,000 and $23,591,000, for the fiscal

years ended March 31, 2002, 2001 and 2000, respectively.

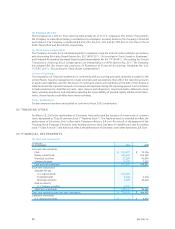

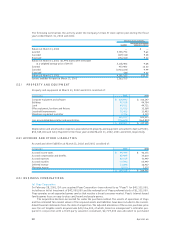

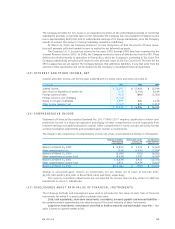

(5) AMERICA ONLINE, INC. (“AOL”) AGREEMENT

In November 1999, Electronic Arts Inc., EA.com and AOL entered into a five-year agreement which estab-

lishes the basis for EA.com’s production of a games site on the world wide web that will be available to

AOL subscribers and to users of other branded AOL properties.

The Company is required to pay to AOL $81,000,000 over the life of the five-year agreement. Of this

amount, $36,000,000 was paid upon signing the agreement with the remainder due in four equal install-

ments on the first four anniversaries of the initial payment.The Company paid AOL $11,250,000 in both

fiscal 2002 and 2001.The fair value of the payments made under the AOL agreement was determined by an

independent valuation and the resulting amounts are being amortized using the straight-line method (begin-

ning with the site launch) over the remaining term of the five-year agreement. Advances of $38,597,000

and $41,462,000 are included in other long-term assets as of March 31, 2002 and 2001, respectively.

The Company made a commitment to spend $15,000,000 in offline media advertisements promoting

their online games, including those on the AOL service, prior to March 31, 2005. As of March 31, 2002, the

Company has spent approximately $3,500,000 against this commitment.

EA 2002 AR

54