Electronic Arts 2002 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2002 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and also supersedes the accounting and reporting provisions of APB Opinion No. 30,

“Reporting the Results

of Operations-Reporting the Effects of Disposal of a Segment of a Business, and Extraordinary, Unusual

and Infrequently Occurring Events and Transactions”

,for the disposal of a segment of a business. SFAS

144 is effective for fiscal years beginning after December 15, 2001 and interim periods within those fiscal

years. We are in the process of determining the impact of this new accounting standard. We believe the

implementation of SFAS 144 will not have a material impact to our consolidated financial statements.

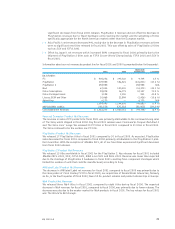

RISK FACTORS

Our business is subject to many risks and uncertainties which may affect our performance. Some of those

risks and uncertainties are as follows:

|•••»Our business is both seasonal and cyclical.

|•••»Our significant investment in EA.com may not be successful or generate profits.

|•••»Acceptance of our online products by paying subscribers is still unproven.

|•••»The business models and technology for e-Commerce and online gaming are still unproven.

|•••»Product development schedules are frequently unreliable, particularly for products for PC and for

online play, and make predicting quarterly results difficult.

|•••»Our business, our products and our distribution are subject to increasing regulation directed at con-

tent, consumer privacy and online delivery in key territories.

|•••»Our platform licensors are our chief competitors and frequently control the manufacturing of our video

game products.

|•••»The current legislative and regulatory environment affecting generally accepted accounting principles

is uncertain and volatile, and significant changes in current principles could affect our financial state-

ments going forward.

For a discussion of these and other important risk factors, see the heading “Risk Factors” in our Annual

Report on Form 10-K for the year ended March 31, 2002.

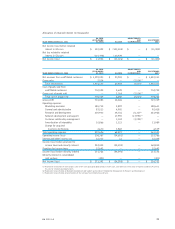

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

MARKET RISK

We are exposed to various market risks, including the changes in foreign currency exchange rates and interest

rates. Market risk is the potential loss arising from changes in market rates and prices. Foreign exchange

contracts used to hedge foreign currency exposures and short-term investments are subject to market risk.

We do not consider our cash and cash equivalents to be subject to interest rate risk due to their short maturi-

ties.We do not enter into derivatives or other financial instruments for trading or speculative purposes.

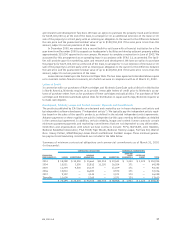

Foreign Currency Exchange Rate Risk

We utilize foreign exchange contracts to hedge foreign currency exposures of underlying assets and liabili-

ties, primarily certain intercompany receivables that are denominated in foreign currencies, thereby, limiting

our risk. Gains and losses on foreign exchange contracts are reflected in the Consolidated Statement of

Operations. At March 31, 2002, we had foreign exchange contracts, all with maturities of less than three

months to purchase and sell approximately $226,330,000 in foreign currencies, primarily British Pounds,

European Currency Units (“Euro”), Canadian Dollars and other currencies.

Fair value represents the difference in value of the contracts at the spot rate and the forward rate.The

counterparties to these contracts are substantial and creditworthy multinational commercial banks.The

risks of counterparty nonperformance associated with these contracts are not considered to be material.

Notwithstanding our efforts to manage foreign exchange risks, there can be no assurances that our hedging

activities will adequately protect us against the risks associated with foreign currency fluctuations.

EA 2002 AR 39