Electronic Arts 2002 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2002 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

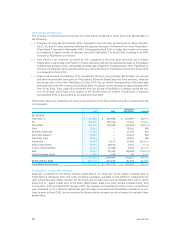

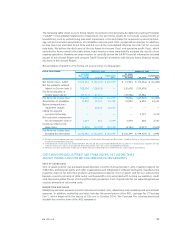

Based on these judgments and assumptions, management determines whether we need to take an impair-

ment charge to reduce the value of the asset stated on our balance sheet to reflect its estimated fair value.

Judgments and assumptions about future values and remaining useful lives are complex and often subjective.

They can be affected by a variety of factors, including but not limited to, significant negative industry or

economic trends, significant changes in the manner or use of the acquired assets or the strategy of our

overall business and significant underperformance relative to expected historical or projected future

operating results. Although we believe the judgments and assumptions management has made in the past

have been reasonable and appropriate, there is nonetheless a high degree of uncertainty and judgment

involved. For example, as part of a restructuring plan to reduce EA.com’s workforce and consolidate facili-

ties in the fiscal year ended March 31, 2002, we recorded impairment charges to write down certain of

EA.com’s depreciable assets and certain intangibles to their estimated fair value and to write off certain

assets which were abandoned.The impairment charges were based on management’s projections regarding

the assets’ remaining useful lives and future values.The EA.com business is still in the growing stages, there-

fore evaluating its business and prospects is more difficult than would be the case for a more mature

business.We continue to encounter the risks and difficulties faced with launching a new business.We

continue to look for ways to streamline the business by consolidating systems and reducing infrastructure

costs. Different judgments and assumptions could materially impact our reported financial results. More

conservative assumptions of the anticipated future benefits from these businesses would result in greater

impairment charges, which would decrease net income and result in lower asset values on our balance sheet.

Conversely, less conservative assumptions would result in smaller impairment charges, higher net income

and higher asset values. Impairment charges on long-lived assets amounted to $12,818,000 for the fiscal

year ended March 31, 2002.There were no impairment charges on long-lived assets for the years ended

March 31, 2001 and 2000.

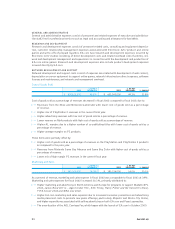

On April 1, 2002, we adopted Statement of Financial Accounting Standards No. 142 (“SFAS 142”),

“Goodwill and Other Intangible Assets”

,which supersedes Accounting Principles Board Opinion No. 17

“Intangible Assets”

.As a result of adopting this standard, we will continue to amortize finite-lived intangi-

bles, but will no longer amortize certain other intangible assets, most notably goodwill and acquired

workforce, which had a net book value at March 31, 2002 of $69,050,000. Amortization of goodwill and

acquired workforce totaled approximately $13,125,000 for fiscal 2002, approximately $9,182,000 for fiscal

2001 and approximately $6,411,000 for fiscal 2000. Based on intangible assets as of March 31, 2002, we

estimate that amortization of finite-lived intangibles will total approximately $8,700,000 for fiscal 2003.

Following adoption of SFAS 142, we will continue to evaluate whether any event has occurred which might

indicate that the carrying value of an intangible asset is not recoverable. In addition, SFAS 142 requires that

goodwill be subject to at least an annual assessment for impairment by applying a fair value-based test.

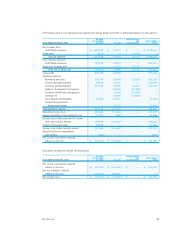

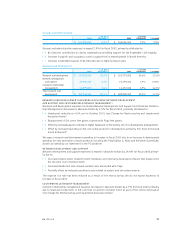

INCOME TAXES

As part of the process of preparing our consolidated financial statements we are required to estimate our

income taxes in each of the jurisdictions in which we operate.This process involves estimating our current tax

exposures in each jurisdiction including the impact, if any, of additional taxes resulting from tax examinations

as well as making judgments regarding the recoverability of deferred tax assets.To the extent recovery of

deferred tax assets is not likely based on our estimation of future taxable income in each jurisdiction, a valua-

tion allowance is established.Tax exposures can involve complex issues and may require an extended period

to resolve.To determine the quarterly tax rate, we are required to estimate full-year income and the related

income tax expense in each jurisdiction.The estimated effective tax rate is adjusted for the tax related to

significant unusual items. Changes in the geographic mix or estimated level of annual pre-tax income can

effect the overall effective tax rate.

EA 2002 AR

16