Electronic Arts 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

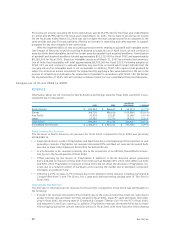

TRANSACTIONS WITH RELATED PARTIES

Square EA

In May 1998, we completed the formation of a new joint venture with Square Co., Ltd. (“Square”), a lead-

ing developer and publisher of entertainment software in Japan. In North America, the companies formed

Square Electronic Arts, LLC (“Square EA”), which has exclusive publishing rights in North America for

future interactive entertainment titles created by Square. Additionally, we have the exclusive right to dis-

tribute in North America products published by this joint venture. Either party may terminate the existence

of Square EA and the distribution agreement effective March 31, 2003.We own a 30% minority interest in

this joint venture while Square owns 70%.This joint venture is accounted for under the equity method.

In March 2002, we announced a publishing and distribution partnership with Square for

Final Fantasy®X

in Asia Pacific.The deal grants us the rights to distribute

Final Fantasy X International

for the PlayStation 2

computer entertainment system in Taiwan, Hong Kong, Singapore,Thailand, Malaysia and Korea.

We generated $80,847,000 in net revenues from sales of Square EA products in fiscal 2002,

$106,586,000 in net revenues from sales of Square EA products in fiscal 2001 and $83,657,000 in net

revenues from sales of Square EA products in fiscal 2000.

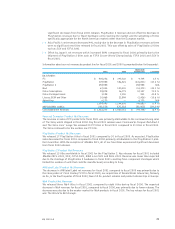

IMPACT OF RECENTLY ISSUED ACCOUNTING STANDARDS

In June 2001, the Financial Accounting Standards Board (“FASB”) issued SFAS 142,

“Goodwill and

Other Intangible Assets”

,which supersedes Accounting Principles Board Opinion No. 17 (“APB 17”),

“Intangible Assets”

.SFAS 142 addresses the accounting treatment for goodwill and other intangible assets

acquired individually or with a group of other assets upon their acquisition, but not acquired in a business

combination.This statement also addresses how goodwill and other intangible assets should be accounted

for after they have been initially recognized in the financial statements. With the adoption of SFAS 142,

goodwill is no longer subject to amortization over its estimated useful life; rather, goodwill will be subject to

at least an annual assessment for impairment by applying a fair-value-based test. Also, if the benefit of an

intangible asset is obtained through contractual or other legal rights, or if the intangible asset can be sold,

transferred, licensed, rented or exchanged, an acquired intangible asset should be separately recognized.The

terms of SFAS 142 are effective as of the beginning of the first quarter of the fiscal year beginning after

December 15, 2001. Certain provisions of SFAS 142 shall be applied to goodwill and other acquired intan-

gible assets for which the acquisition date is after June 30, 2001. On April 1, 2002, we adopted SFAS 142.

As a result of adopting this standard, we will continue to amortize finite-lived intangibles, but will no longer

amortize certain other intangible assets, most notably goodwill and acquired workforce, which had a net

book value at March 31, 2002 of $69,050,000. Amortization of goodwill and acquired workforce totaled

approximately $13,125,000 for fiscal 2002, approximately $9,182,000 for fiscal 2001 and approximately

$6,411,000 for fiscal 2000. Based on intangible assets as of March 31, 2002, we estimate that amortiza-

tion of finite-lived intangibles will total approximately $8,700,000 for fiscal 2003. Following adoption of

SFAS 142, we will continue to evaluate whether any event has occurred which might indicate that the car-

rying value of an intangible asset is not recoverable. In addition, SFAS 142 requires that goodwill be subject

to at least an annual assessment for impairment by applying a fair value-based test.We are in the process

of completing an evaluation for impairment of goodwill in accordance with SFAS 142. We believe the

implementation of SFAS 142 will not have a material impact on our consolidated financial statements.

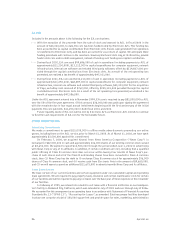

In June 2001, the FASB issued Statement of Financial Accounting Standards No.143 (“SFAS 143”),

“Accounting for Asset Retirement Obligations”

.SFAS 143 addresses financial accounting and reporting

for obligations associated with the retirement of tangible long-lived assets and the associated asset retire-

ment costs.This statement applies to legal obligations associated with the retirement of long-lived assets

that result from the acquisition, construction, development or normal use of the asset. SFAS 143 is effec-

tive for fiscal years beginning after June 15, 2002. We do not expect the adoption of SFAS 143 to have a

material impact on our consolidated financial position or results of operations.

In October 2001, the FASB issued Statement of Financial Accounting Standards No. 144 (“SFAS

144”),

“Accounting for the Impairment or Disposal of Long-Lived Assets”

,which addresses financial

accounting and reporting for the impairment or disposal of long-lived assets. SFAS 144 supersedes SFAS

121,

“Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to Be Disposed Of”

,

EA 2002 AR

38