Electronic Arts 2002 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2002 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

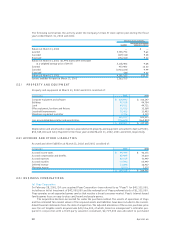

(b) Kesmai

On February 7, 2000, the Company acquired Kesmai Corporation (now referred to as “Kesmai”) from News

America Corporation (“News Corp”) in exchange for $22,500,000 in cash and approximately 206,000

shares of its existing common stock valued at $8,650,000.The Company granted 5 percent of the initial

equity attributable to EA.com to News Corp, adjusting the total common stock consideration relating to the

acquisition by $703,000 to $9,353,000.The Company has contributed Kesmai to EA.com.

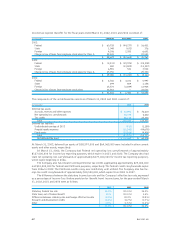

The Company also agreed to spend $12,500,000 through the period ended June 1, 2002 in advertising

with News Corp or any of its affiliates. In addition, if certain conditions are met, including that a qualified

public offering of Class B common stock does not occur within twenty-four months of News Corp’s purchase

of such shares and all of the Class B outstanding shares have been converted to Class A common stock, then

(1) News Corp has the right to (i) exchange Class B common stock for approximately 206,000 shares of

Class A common stock, and (ii) receive cash from Electronic Arts in the amount of $9,650,000, and (2) the

Company will agree to spend an additional $11,675,000 in advertising with News Corp and its affiliates.

The acquisition has been accounted for under the purchase method.The results of operations of Kesmai

and the estimated fair market values of the acquired assets and liabilities have been included in the consoli-

dated financial statements from the date of acquisition.The adjusted allocation of the excess purchase price

over the net tangible liabilities assumed was $32,815,000, of which, based on management’s estimates pre-

pared in conjunction with a third party valuation consultant, $3,869,000 was allocated to purchased

in-process research and development and $28,946,000 was allocated to other intangible assets. Amounts

allocated to other intangibles include goodwill of $18,932,000, existing technology of $3,992,000,

amounts attributed to a prior AOL agreement of $3,131,000 and other intangibles of $2,891,000.The

allocation of intangible assets is being amortized over lives ranging from two to seven years.

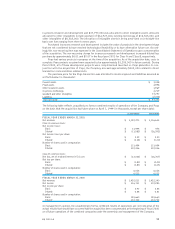

As part of the restructuring plan announced in fiscal 2002 for EA.com, the Company evaluated its

intangibles for impairment in accordance with Statement of Financial Accounting Standards No. 121

(“SFAS 121”),

“Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to Be

Disposed Of”

.The Company assessed the recoverability of its intangibles by determining whether the carry-

ing amount of the assets was recoverable through estimated future undiscounted net cash flows. The

Company calculated the impairment loss as the amount that the carrying value of the asset exceeded the

discounted future cash flows.The Company recorded in restructuring and asset impairment charges a write-

off of $1,014,000 related to certain other intangibles associated with Kesmai. These intangibles had

remaining lives ranging from 15 to 39 months.

Purchased in-process research and development includes the value of products in the development

stage that are not considered to have reached technological feasibility or to have alternative future use.

Accordingly, this non-recurring item was expensed in the Consolidated Statement of Operations upon con-

summation of the acquisition.The non-recurring charge for in-process research and development reduced

diluted earnings per share by $0.02 in the fiscal year 2000.

Kesmai had various projects in progress at the time of the acquisition. As of the acquisition date, costs

to complete Kesmai projects acquired were approximately $10,550,000 in future periods. During fiscal

2002 and fiscal 2001, all of these development projects were completed and launched on the EA.com game-

sites.The resources were redirected to ongoing live game operations or to building the EA.com publishing

platform. As a result, the Company does not anticipate incurring significant future development costs in

relation to these projects after fiscal 2002. In conjunction with the acquisition of Kesmai, the Company

accrued approximately $200,000 related to direct transaction costs and other related costs.

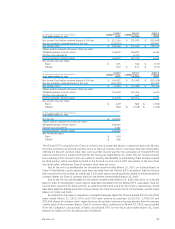

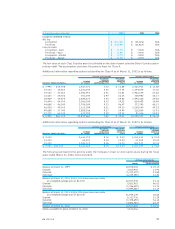

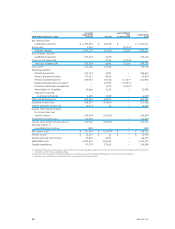

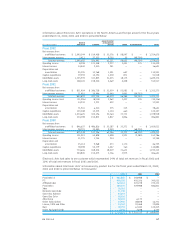

The purchase price for the Kesmai transaction was allocated to assets acquired and liabilities assumed as

set forth below (in thousands):

Current assets $605

Fixed assets (net of depreciation) 759

In-process technology 3,869

Goodwill and other intangibles 28,946

Liabilities (2,326)

Total cash and stock paid $31,853

EA 2002 AR

60