Dish Network 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-13

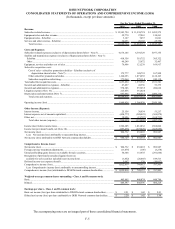

Revenue Recognition

We recognize revenue when an arrangement exists, prices are determinable, collectibility is reasonably

assured and the goods or services have been delivered. Revenue from our subscription television services

is recognized when programming is broadcast to subscribers. Payments received from subscribers in

advance of the broadcast or service period are recorded as “Deferred revenue and other” in our

Consolidated Balance Sheets until earned.

For certain of our promotions relating to our receiver systems and HD programming, subscribers are charged

an upfront fee. A portion of this fee may be deferred and recognized over the estimated subscriber life for

new subscribers or the estimated remaining life for existing subscribers ranging from 18 months to five years.

Revenue from advertising sales is recognized when the related services are performed.

Subscriber fees for equipment rental, including DVRs, additional outlets and fees for receivers with

multiple tuners, and our in-home service operations are recognized as revenue as earned. Revenue from

equipment sales and equipment upgrades are recognized upon shipment to customers.

Certain of our existing and new subscriber promotions include programming discounts. Programming

revenues are recorded as earned at the discounted monthly rate charged to the subscriber. See “Subscriber

Acquisition Costs” below for discussion regarding the accounting for costs under these promotions.

Subscriber-Related Expenses

The cost of television programming distribution rights is generally incurred on a per subscriber basis and

various upfront carriage payments are recognized when the related programming is distributed to

subscribers. Recently, we entered into long-term flat rate programming contracts that are charged to

expense using the straight-line method over the term of the agreement. In addition, the cost of television

programming rights to distribute live sporting events for a season or tournament is charged to expense

using the straight-line method over the course of the season or tournament. “Subscriber-related expenses”

in the Consolidated Statements of Operations and Comprehensive Income (Loss) principally include

programming expenses, costs incurred in connection with our in-home service and call center operations,

billing costs, refurbishment and repair costs related to receiver systems, subscriber retention and other

variable subscriber expenses. These costs are recognized as the services are performed or as incurred.

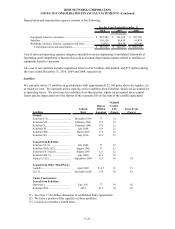

Subscriber Acquisition Costs

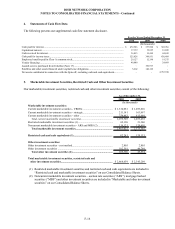

Subscriber acquisition costs in our Consolidated Statements of Operations and Comprehensive Income (Loss)

consist of costs incurred to acquire new subscribers through third parties and our direct sales distribution

channel. Subscriber acquisition costs include the following line items from our Consolidated Statements of

Operations and Comprehensive Income (Loss):

• “Cost of sales – subscriber promotion subsidies - EchoStar” includes the cost of our receiver

systems sold to retailers and other distributors of our equipment and receiver systems sold directly by

us to subscribers.

• “Other subscriber promotion subsidies” includes net costs related to promotional incentives and

costs related to installation.

• “Subscriber acquisition advertising” includes advertising and marketing expenses related to the

acquisition of new DISH Network subscribers. Advertising costs are expensed as incurred.