Dish Network 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-21

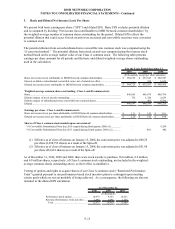

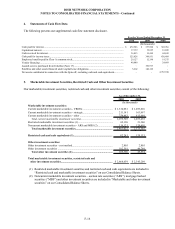

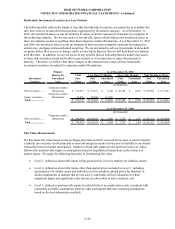

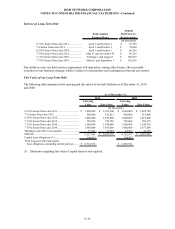

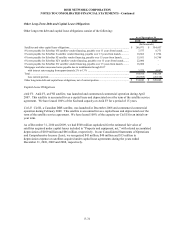

Our assets measured at fair value on a recurring basis were as follows:

Total Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3

(In thousands)

Debt securities:

VRDNs........................................................ 1,334,081$ -$ 1,334,081$ -$ 1,053,826$ -$ 1,053,826$ -$

ARS and MBS............................................. 119,121 - 6,031 113,090 120,650 - 7,907 112,743

Other (including restricted)........................ 888,621 21,835 810,883 55,903 917,069 22,031 894,770 268

Equity securities............................................ 195,022 195,022 - - 83,957 83,957 - -

Subtotal.......................................................... 2,536,845 216,857$ 2,150,995$ 168,993$ 2,175,502$ 105,988$ 1,956,503$ 113,011$

Less certain other investment securities ..... (55,823)

Total marketable investment securities....... 2,481,022$

As of

December 31, 2010 December 31, 2009

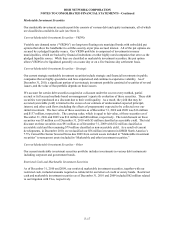

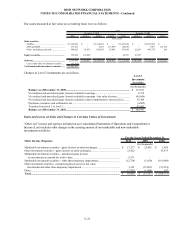

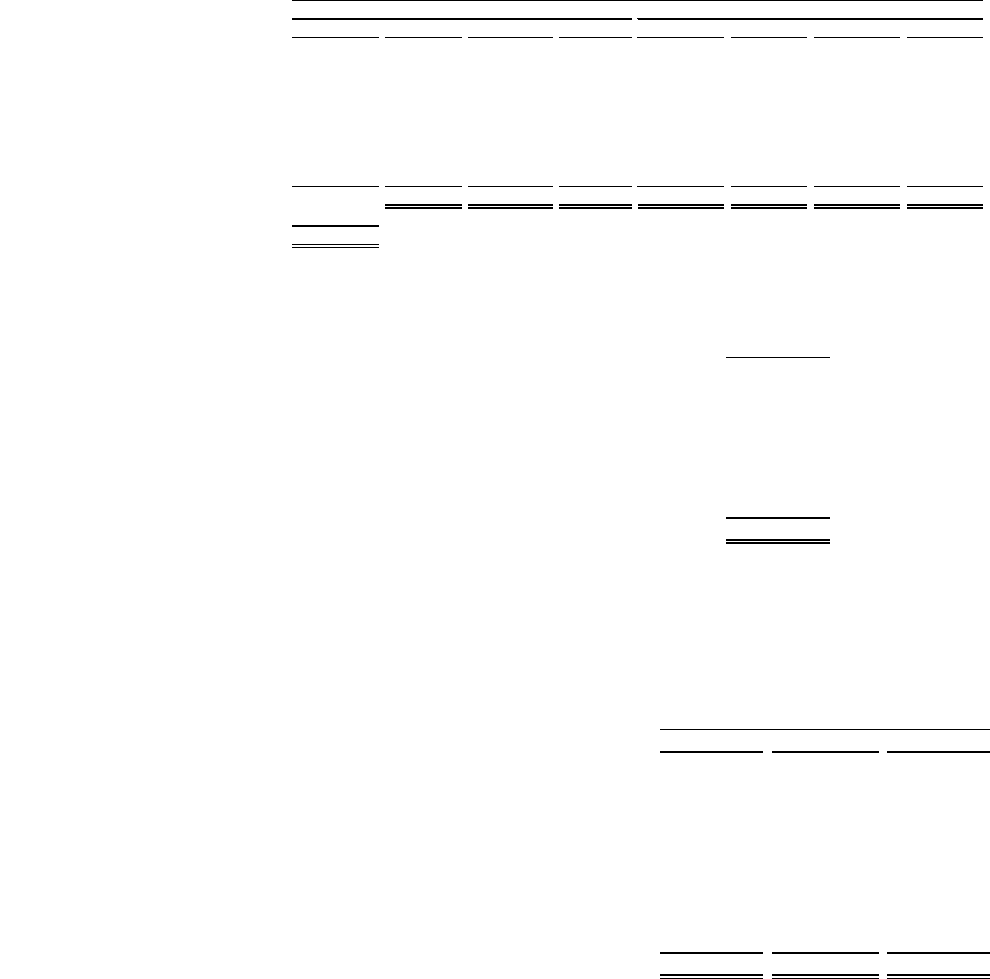

Changes in Level 3 instruments are as follows:

Level 3

Investment

Securities

(In thousands)

Balance as of December 31, 2009............................................................................................... 113,011$

Net realized and unrealized gains (losses) included in earnings................................................... 6,732

Net realized and unrealized gains (losses) included in earnings - fair value election.................... (49,656)

Net realized and unrealized gains (losses) included in other comprehensive income (loss)......... 55,308

Purchases, issuances and settlements, net .................................................................................... (4,085)

Transfers from level 2 to level 3................................................................................................... 47,683

Balance as of December 31, 2010............................................................................................... 168,993$

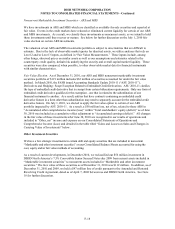

Gains and Losses on Sales and Changes in Carrying Values of Investments

“Other, net” income and expense included on our Consolidated Statements of Operations and Comprehensive

Income (Loss) includes other changes in the carrying amount of our marketable and non-marketable

investments as follows:

Other Income (Expense): 2010 2009 2008

Marketable investment securities - gains (losses) on sales/exchanges.................................. $ 13,277 $ 23,042 $ 2,095

Other investment securities - gains (losses) on sales/exchanges........................................... 21,422 - 53,473

Marketable investment securities - unrealized gains (losses)

on investments accounted for at fair value....................................................................... 8,371 - -

Marketable investment securities - other-than-temporary impairments................................ (12,734) (1,050) (191,404)

Other investment securities - unrealized gains (losses) on fair value

investments and other-than-temporary impairments ........................................................ 3,361 (35,803) (33,534)

Other..................................................................................................................................... (2,701) (1,896) 657

Total..................................................................................................................................... 30,996$ (15,707)$ (168,713)$

For the Years Ended December 31,

(In thousands)