Dish Network 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

60

60

Stock Repurchases

Our Board of Directors previously authorized stock repurchases of up to $1.0 billion of our Class A common stock.

On November 2, 2010, our Board of Directors extended the plan and authorized an increase in the maximum dollar

value of shares that may be repurchased under the plan, such that we are currently authorized to repurchase up to

$1.0 billion of our outstanding shares of our Class A common stock through and including December 31, 2011. As

of December 31, 2010, we may repurchase up to $1.0 billion under this plan.

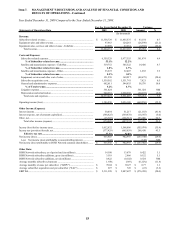

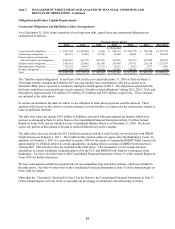

The following table provides information regarding repurchases of our Class A common stock.

Class A Common Stock Re

p

urchases 2010 2009 2008

Total number of shares repurchased.................... 6,020 1,948 3,137

Dollar value of shares repurchased...................... $ 107,079 $ 18,594 $ 82,733

(In thousands)

For the Years Ended December 31,

Subscriber Acquisition and Retention Costs

We incur significant upfront costs to acquire subscribers, including advertising, retailer incentives, equipment,

installation, and new customer promotions. While we attempt to recoup these upfront costs over the lives of their

subscription, there can be no assurance that we will. We deploy business rules such as minimum credit

requirements and we strive to provide outstanding customer service, to increase the likelihood of customers keeping

their DISH Network service over longer periods of time. Our subscriber acquisition costs may vary significantly

from period to period.

We incur significant costs to retain our existing customers, mostly by upgrading their equipment to HD and DVR

receivers. As with our subscriber acquisition costs, our retention spending includes the cost of equipment and

installation. In certain circumstances, we also offer free programming and/or promotional pricing for limited

periods for existing customers in exchange for a commitment to receive service for a minimum term. A component

of our retention efforts includes the installation of equipment for customers who move. Our subscriber retention

costs may vary significantly from period to period.

Other

We are also vulnerable to fraud, particularly in the acquisition of new subscribers. While we are addressing the

impact of subscriber fraud through a number of actions, there can be no assurance that we will not continue to

experience fraud, which could impact our subscriber growth and churn. Sustained economic weakness may create

greater incentive for signal theft and subscriber fraud, which could lead to higher subscriber churn and reduced

revenue.