Dish Network 2010 Annual Report Download - page 50

Download and view the complete annual report

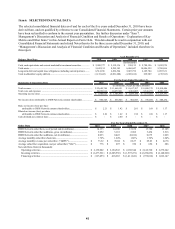

Please find page 50 of the 2010 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

43

43

To combat signal theft and improve the security of our broadcast system, we completed the replacement of our

security access devices to re-secure our system during 2009. We expect that additional future replacements of these

devices will be necessary to keep our system secure. To combat other forms of fraud, we continue to monitor our

third party distributors to ensure adherence to our business rules.

While we have made improvements in responding to and dealing with customer service issues, we continue to focus

on the prevention of these issues, which is critical to our business, financial position and results of operations. To

address our operational inefficiencies, we continue to focus on simplifying and standardizing our operations. For

example, we have streamlined our hardware offerings and continue to make significant investments in staffing,

training, information systems, and other initiatives, primarily in our call center and in-home service operations.

These investments are intended to help combat inefficiencies introduced by the increasing complexity of our

business, improve customer satisfaction, reduce churn, increase productivity and allow us to scale better over the

long run. We cannot, however, be certain that our increased spending will ultimately be successful in yielding such

returns.

We have been investing more in advanced technology equipment as part of our subscriber acquisition and retention

efforts. Initiatives to transmit certain programming only in MPEG-4 and to activate most new subscribers only with

MPEG-4 receivers have accelerated our deployment of MPEG-4 receivers. To meet current demand, we have

increased the rate at which we upgrade existing subscribers to HD and DVR receivers. While these efforts may

increase our subscriber acquisition and retention costs, we believe that they will help mitigate subscriber churn in

the future and reduce costs over the long run.

We are also continuing to change equipment for certain subscribers to make more efficient use of transponder

capacity in support of HD and other initiatives. We expect to continue these initiatives through 2011. We believe

that the benefit from the increase in available transponder capacity outweighs the short-term cost of these equipment

changes.

To maintain and enhance our competitiveness over the long term, we are promoting a suite of integrated products

designed to maximize the convenience and ease of watching TV anytime and anywhere, referred to as “TV

Everywhere.” TV Everywhere utilizes, among other things, online access and Slingbox “placeshifting” technology.

There can be no assurance that these integrated products will positively affect our results of operations or our gross new

subscriber additions.

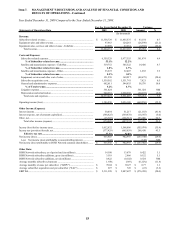

Liquidity Drivers

Like many companies, we make general investments in property such as satellites, information technology and

facilities that support our overall business. As a subscriber-based company, however, we also make subscriber-

specific investments to acquire new subscribers and retain existing subscribers. While the general investments may

be deferred without impacting the business in the short-term, the subscriber-specific investments are less

discretionary. Our overall objective is to generate sufficient cash flow over the life of each subscriber to provide an

adequate return against the upfront investment. Once the upfront investment has been made for each subscriber, the

subsequent cash flow is generally positive.

There are a number of factors that impact our future cash flow compared to the cash flow we generate at a given

point in time. The first factor is how successful we are at retaining our current subscribers. As we lose subscribers

from our existing base, the positive cash flow from that base is correspondingly reduced. The second factor is how

successful we are at maintaining our subscriber-related margins. To the extent our “Subscriber-related expenses”

grow faster than our “Subscriber-related revenue,” the amount of cash flow that is generated per existing subscriber

is reduced. The third factor is the rate at which we acquire new subscribers. The faster we acquire new subscribers,

the more our positive ongoing cash flow from existing subscribers is offset by the negative upfront cash flow

associated with new subscribers. Finally, our future cash flow is impacted by the rate at which we make general

investments and any cash flow from financing activities.