Dillard's 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

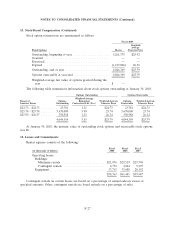

18. Quarterly Results of Operations (unaudited) (Continued)

Fiscal 2008, Three Months Ended

(in thousands of dollars, except per share data) May 3 August 2 November 1 January 31

Net sales ............................... $1,675,554 $1,607,823 $1,508,230 $2,038,936

Gross profit ............................. 557,252 478,457 461,802 505,263

Net income (loss) ......................... 2,693 (38,340) (56,070) (149,348)

Diluted earnings per share:

Net income (loss) ......................... $ 0.04 $ (0.51) $ (0.76) $ (2.03)

Total of quarterly earnings per common share may not equal the annual amount because net

income per common share is calculated independently for each quarter.

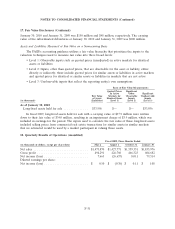

Quarterly information for fiscal 2009 and fiscal 2008 includes the following items:

First Quarter

2009

• a $1.5 million pretax gain ($0.9 million after tax or $0.01 per share) on the early extinguishment

of debt related to the repurchase of certain unsecured notes.

2008

• a $0.9 million pretax charge ($0.6 million after tax or $0.01 per share) for asset impairment and

store closing charges related to the write-off of equipment and accrual of future rent on a

distribution center that was closed during the quarter.

Second Quarter

2008

• a $17.6 million pretax gain ($11.0 million after tax or $0.15 per share) related to the sale of an

airplane.

• a $9.8 million pretax charge ($6.1 million after tax or $0.08 per share) for asset impairment and

store closing charges for a store closed during the quarter and for a write-down of property and

equipment on four stores scheduled to be closed during the year.

Third Quarter

2009

• a $10.6 million income tax benefit ($0.14 per diluted share) primarily due to state administrative

settlement and a decrease in a capital loss valuation allowance.

2008

• a $9.3 million pretax charge ($5.9 million after tax or $0.08 per share) related to the accrual of

rent and property taxes for a store closed during the quarter and a write-down of property and

equipment on three stores scheduled to closed by the end of the year.

• a $4.4 million pretax charge ($2.8 million after tax or $0.04 per share) for hurricane-related

expenses.

F-32