Dillard's 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

17. Fair Value Disclosures (Continued)

January 30, 2010 and January 31, 2009 was $150 million and $48 million, respectively. The carrying

value of the subordinated debentures at January 30, 2010 and January 31, 2009 was $200 million.

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

The FASB’s accounting guidance utilizes a fair value hierarchy that prioritizes the inputs to the

valuation techniques used to measure fair value into three broad levels:

• Level 1: Observable inputs such as quoted prices (unadjusted) in active markets for identical

assets or liabilities

• Level 2: Inputs, other than quoted prices, that are observable for the asset or liability, either

directly or indirectly; these include quoted prices for similar assets or liabilities in active markets

and quoted prices for identical or similar assets or liabilities in markets that are not active

• Level 3: Unobservable inputs that reflect the reporting entity’s own assumptions

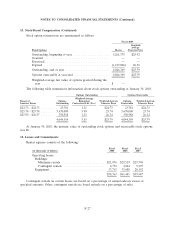

Basis of Fair Value Measurements

Quoted Prices Significant

In Active Other Significant

Fair Value Markets for Observable Unobservable

of Assets Identical Items Inputs Inputs

(in thousands) (Liabilities) (Level 1) (Level 2) (Level 3)

As of January 30, 2010

Long-lived assets held for sale .............. $33,956 $— $— $33,956

In fiscal 2009, long-lived assets held for sale with a carrying value of $37.9 million were written

down to their fair value of $34.0 million, resulting in an impairment charge of $3.9 million, which was

included in earnings for the period. The inputs used to calculate the fair value of these long-lived assets

included selling prices from commercial real estate transactions for similar assets in similar markets

that we estimated would be used by a market participant in valuing these assets.

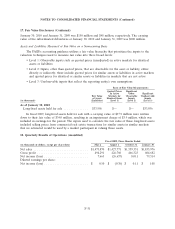

18. Quarterly Results of Operations (unaudited)

Fiscal 2009, Three Months Ended

(in thousands of dollars, except per share data) May 2 August 1 October 31 January 30

Net sales ............................... $1,473,870 $1,427,771 $1,359,331 $1,833,976

Gross profit ............................. 494,291 426,760 466,323 604,682

Net income (loss) ......................... 7,663 (26,657) 8,011 79,514

Diluted earnings per share:

Net income (loss) ......................... $ 0.10 $ (0.36) $ 0.11 $ 1.08

F-31