Dillard's 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11. Stockholders’ Equity (Continued)

the Board of Directors. Shares of Class B are convertible at the option of any holder thereof into

shares of Class A at the rate of one share of Class B for one share of Class A.

On March 2, 2002, the Company adopted a shareholder rights plan under which the Board of

Directors declared a dividend of one preferred share purchase right for each outstanding share of the

Company’s Common Stock, which includes both the Company’s Class A and Class B Common Stock,

payable on March 18, 2002 to the shareholders of record on that date. Each right, which is not

presently exercisable, entitles the holder to purchase one one-thousandth of a share of Series A Junior

Participating Preferred Stock for $70 per one one-thousandth of a share of Preferred Stock, subject to

adjustment. In the event that any person acquires 15% or more of the outstanding shares of common

stock, each holder of a right (other than the acquiring person or group) will be entitled to receive,

upon payment of the exercise price, shares of Class A Common Stock having a market value of two

times the exercise price. The rights will expire, unless extended, redeemed or exchanged by the

Company, on March 2, 2012.

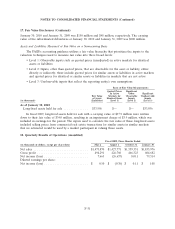

Stock Repurchase Programs

2007 Stock Plan

In November 2007, the Company’s Board of Directors authorized the Company to repurchase up

to $200 million of its Class A Common Stock (‘‘2007 Stock Plan’’). This open-ended authorization

permits the Company to repurchase its Class A Common Stock in the open market or through

privately negotiated transactions. No shares were repurchased during fiscal 2009 and 2007 under the

2007 Stock Plan. During fiscal 2008, the Company repurchased 1,826,600 shares of stock for

$17.4 million at an average price of $9.55 per share. Stock repurchase authorization remaining under

the 2007 Stock Plan at January 30. 2010 was $182.6 million.

2005 Stock Plan

In May 2005, The Company’s Board of Directors approved the repurchase of up to $200 million of

its Class A Common Stock (‘‘2005 Stock Plan’’). Remaining availability under the 2005 Stock Plan at

the beginning of fiscal 2007 was approximately $112 million. During fiscal 2007, the Company

repurchased 5.2 million shares of stock for approximately $112 million which completed the

authorization under the 2005 Stock Plan.

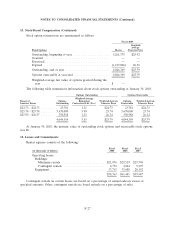

12. Earnings (Loss) per Share

Basic earnings per share has been computed based upon the weighted average of Class A and

Class B common shares outstanding. Diluted earnings per share gives effect to outstanding stock

options.

F-25