Dillard's 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

14. Leases and Commitments (Continued)

Various other legal proceedings, in the form of lawsuits and claims, which occur in the normal

course of business, are pending against the Company and its subsidiaries. In the opinion of

management, disposition of these matters is not expected to materially affect the Company’s financial

position, cash flows or results of operations

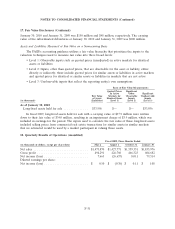

15. Insurance Proceeds

During fiscal 2005, Hurricane Katrina, Hurricane Rita and Hurricane Wilma interrupted

operations in approximately 60 of the Company’s stores for varying amounts of time. Ten stores

suffered damage to either merchandise or property related to the hurricanes. One store in the New

Orleans area was permanently closed. A store in Biloxi, Mississippi was closed throughout the

remainder of fiscal 2005 and remained closed for clean-up and reconstruction until its re-opening in

March 2008.

Property and merchandise losses in the affected stores were covered by insurance. Insurance

proceeds of $22.0 million were received during fiscal 2007. The Company recorded related gains in

fiscal 2007 of $14.1 million and $4.1 million in gain on disposal of assets and cost of sales, respectively.

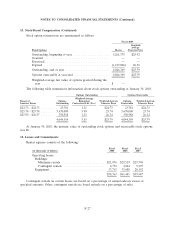

16. Asset Impairment and Store Closing Charges

During fiscal 2009, the Company recorded a pretax charge of $3.1 million for asset impairment and

store closing costs. The charge consists of the write-down of property of $3.9 million on two stores

closed in a prior year partially offset by the renegotiation of a future rent accrual of $0.8 million on a

store closed in a prior year.

During fiscal 2008, the Company recorded a pretax charge of $197.9 million for asset impairment

and store closing costs. The charge consists of (1) the write-off of $31.9 million of goodwill on seven

stores and a write-down of $58.8 million of investment in two mall joint ventures where the estimated

future cash flows were unable to sustain the amount of goodwill and investment; (2) an accrual of

$0.9 million for future rent, property tax and utility payments on one store that was closed during the

year; (3) a write-down of property and equipment and an accrual for future rent, property tax and

utility payments of $5.7 million on a store and distribution center that were closed during the year and

(4) a write-down of property and equipment on 32 stores that were closed, scheduled to close or

impaired based on the inability of the stores’ estimated future cash flows to sustain their carrying value.

During fiscal 2007, the Company recorded a pretax charge of $20.5 million for asset impairment

and store closing costs. The charge consists of a write-off of goodwill on one store of $2.6 million, an

accrual for future rent, property tax and utility payments on two stores of $1.0 million and a

write-down of property and equipment on 14 stores for $16.9 million.

F-29