Dillard's 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Dillard's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

8. Income Taxes (Continued)

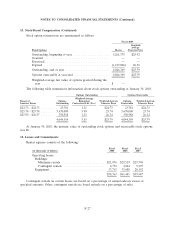

A reconciliation between the Company’s income tax provision and income taxes using the federal

statutory income tax rate is presented below:

Fiscal Fiscal Fiscal

(in thousands of dollars) 2009 2008 2007

Income tax at the statutory federal rate (inclusive of equity in (losses)

earnings of joint ventures) ............................... $28,427 $(133,555) $23,370

State income taxes, net of federal benefit (inclusive of equity in

(losses) earnings of joint ventures) ......................... (89) (6,538) 1,585

Net changes in unrecognized tax benefits, interest, and penalties /

reserves ............................................. (6,334) 2,495 (5,867)

Tax benefit of federal credits ............................... (2,405) (4,069) (3,340)

Nondeductible goodwill write off ............................ — 11,680 933

Changes in cash surrender value of life insurance policies .......... (795) (803) (914)

Changes in valuation allowance ............................. (4,024) (10,492) (1,733)

Changes in tax rate ...................................... (1,317) — —

Other ................................................ (773) 762 307

Tax benefit of state restructuring ............................ — — (1,331)

$12,690 $(140,520) $13,010

During fiscal 2009, income taxes included the net decrease in unrecognized tax benefits, interest,

and penalties of approximately $6.3 million and included the recognition of tax benefits of

approximately $1.3 million for a decrease in deferred liabilities due to a decrease in the state effective

tax rate, approximately $4.4 million for a decrease in a capital loss valuation allowance resulting from

capital gain income, and approximately $2.4 million due to federal tax credits. During fiscal 2009, the

Company reached a settlement with a state taxing jurisdiction which resulted in a reduction in

unrecognized tax benefits, interest, and penalties.

During fiscal 2008, income taxes included the net increase in unrecognized tax benefits, interest,

and penalties of approximately $2.5 million and included the recognition of tax benefits of

approximately $10.5 million for a decrease in a capital loss valuation allowance resulting from capital

gain income and approximately $4.1 million due to federal tax credits.

During fiscal 2007, income taxes included the net decrease in unrecognized tax benefits, interest,

and penalties of approximately $5.9 million, and a recognition of tax benefits of approximately

$1.7 million for a decrease in a capital loss valuation allowance resulting from capital gain income,

approximately $1.3 million for a reduction in state tax liabilities due to a restructuring that occurred

during this period and approximately $3.3 million due to federal tax credits. In fiscal 2007, the

Company reached a settlement with a state taxing jurisdiction which necessitated changes in

unrecognized tax benefits, interest, and penalties.

Deferred income taxes reflect the net tax effects of temporary differences between the carrying

amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax

F-19