Dell 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

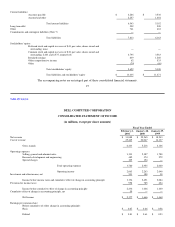

Income before income taxes and cumulative effect of change in accounting principle included approximately $491 million,

$449 million, and $529 million related to foreign operations in fiscal years 2001, 2000, and 1999, respectively.

36

Table of Contents

The Company has not recorded a deferred income tax liability of approximately $492 million for additional taxes that would result

from the distribution of certain earnings of its foreign subsidiaries if they were repatriated. The Company currently intends to reinvest

indefinitely these undistributed earnings of its foreign subsidiaries.

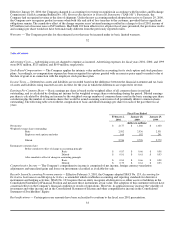

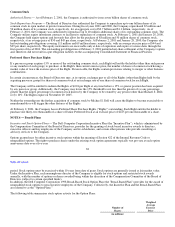

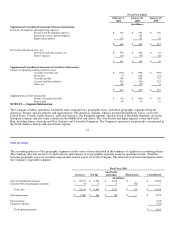

The components of the Company's net deferred tax asset are as follows:

Fiscal Year Ended

February 2, January 28, January 29,

2001 2000 1999

(in millions)

Deferred tax assets:

Deferred service contract income $ 148 $ 125 $ 118

Inventory and warranty provisions 81 60 45

Provisions for product returns and doubtful accounts 44 30 25

Loss carryforwards 73 219 —

Credit carryforwards 188 101 —

Other 64 — —

598 535 188

Deferred tax liabilities:

Unrealized gains on investments (47) (303) (2)

Other — (74) (49)

Net deferred tax asset $ 551 $ 158 $ 137

Tax loss carryforwards will generally expire in 2020. Credit carryforwards will generally expire between 2002 and 2022.

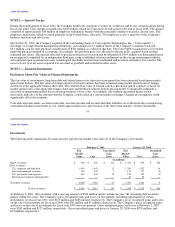

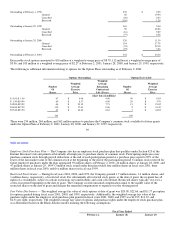

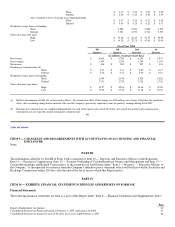

The effective tax rate differed from statutory U.S. federal income tax rate as follows:

Fiscal Year Ended

February 2, January 28, January 29,

2001 2000 1999

U.S. federal statutory rate 35.0% 35.0% 35.0%

Foreign income taxed at different rates (5.8) (6.0) (7.0)

Nondeductible purchase of in-process research and development — 2.8 —

Other 0.8 0.2 2.0

Effective tax rates 30.0% 32.0% 30.0%

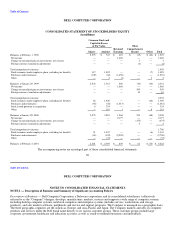

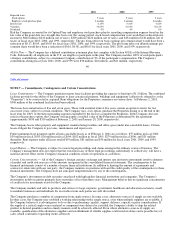

NOTE 5 — Capitalization

Preferred Stock

Authorized Shares — The Company has the authority to issue five million shares of preferred stock, par value $.01 per share. At

February 2, 2001 and January 28, 2000 no shares of preferred stock were issued or outstanding.

Series A Junior Participating Preferred Stock — In conjunction with the distribution of Preferred Share Purchase Rights (see below),

the Company's Board of Directors designated 200,000 shares of preferred stock as Series A Junior Participating Preferred Stock

("Junior Preferred Stock") and reserved such shares for issuance upon exercise of the Preferred Share Purchase Rights. At February 2,

2001 and January 28, 2000, no shares of Junior Preferred Stock were issued or outstanding.

37

Table of Contents