Dell 2000 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2000 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

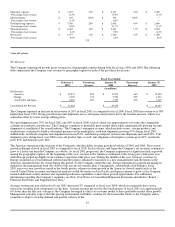

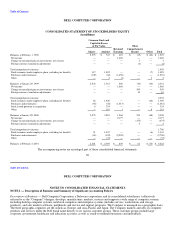

shares over a four year period out of its authorized 1 billion share repurchase program, for an aggregate cost of $6.8 billion. During

fiscal year 2001, the Company repurchased 65 million shares of common stock for an aggregate cost of $2.7 billion. The Company

utilizes equity instrument contracts to facilitate its repurchase of common stock. At February 2, 2001 and January 28, 2000, the

Company held equity options and forwards that allow for the purchase of 88 million and 50 million shares of common stock,

respectively, at an average price of $50 and $45 per share, respectively. At February 2, 2001 and January 28, 2000, the Company also

had outstanding put obligations covering 111 million and 69 million shares, respectively, with an average exercise price of $44 and

$39 per share, respectively. The equity instruments are exercisable only at the date of expiration and expire at various dates through

the first quarter of fiscal 2004. The outstanding put obligations at February 2, 2001 permitted net share settlement at the Company's

option and, therefore, did not result in a put obligation liability on the accompanying Consolidated Statement of Financial Position.

For additional information regarding the Company's stock repurchase program, see Note 5 of Notes to Consolidated Financial

Statements included in "Item 8 — Financial Statements and Supplementary Data" below.

The Company utilized $482 million in cash during fiscal year 2001 to improve and equip its manufacturing and office facilities as the

Company continues to grow. Cash flows for similar capital expenditures for fiscal year 2002 are currently expected to be in the range

of $300 to $350 million.

The Company maintains master lease facilities providing the capacity to fund up to $1.2 billion. The combined facilities provide for

the ability of the Company to lease certain real property, buildings and equipment to be constructed or acquired. At February 2, 2001,

$506 million of the combined facilities had been utilized.

22

Table of Contents

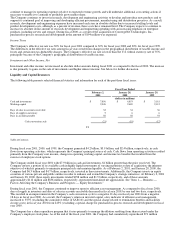

In April 1998, the Company issued $200 million in Senior Notes due April 15, 2008 and $300 million in Senior Debentures due

April 15, 2020. For additional information regarding these issuances, see Note 3 of Notes to Consolidated Financial Statements

included in "Item 8 — Financial Statements and Supplementary Data."

The Company maintains a $250 million revolving credit facility, which expires in June 2002. At February 2, 2001 this facility was

unused.

Management believes that the Company's cash provided from operations will continue to be sufficient to support its operations and

capital requirements. The Company anticipates that it will continue to utilize its strong liquidity and cash flows to repurchase its

common stock, make strategic equity investments and invest in systems and processes, as well as invest in the development and

growth of its enterprise products.

Market Risk

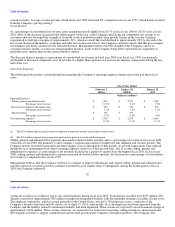

The Company is exposed to a variety of risks, including foreign currency exchange rate fluctuations and changes in the market value

of its investments. In the normal course of business, the Company employs established policies and procedures to manage these risks.

Foreign Currency Hedging Activities

The Company's objective in managing its exposure to foreign currency exchange rate fluctuations is to reduce the impact of adverse

fluctuations on earnings and cash flows associated with foreign currency exchange rate changes. Accordingly, the Company utilizes

foreign currency option contracts and forward contracts to hedge its exposure on anticipated transactions and firm commitments in

most of the foreign countries in which the Company operates. The principal currencies hedged during fiscal year 2001 were the British

pound, Japanese yen, Euro and Canadian dollar. The Company monitors its foreign currency exchange exposures daily to ensure the

overall effectiveness of its foreign currency hedge positions. However, there can be no assurance the Company's foreign currency

hedging activities will substantially offset the impact of fluctuations in currency exchange rates on its results of operations and

financial position.

Based on the Company's foreign currency exchange instruments outstanding at February 2, 2001, the Company estimates a maximum

potential one-day loss in fair value of approximately $21.4 million, using a Value-at-Risk ("VAR") model. The VAR model estimates

were made assuming normal market conditions and a 95% confidence level. The Company used a Monte Carlo simulation type model

that valued its foreign currency instruments against a thousand randomly generated market price paths. Anticipated transactions, firm

commitments, receivables and accounts payable denominated in foreign currencies were excluded from the model. The VAR model is

a risk estimation tool, and as such, is not intended to represent actual losses in fair value that will be incurred by the Company.

Additionally, as the Company utilizes foreign currency instruments for hedging anticipated and firmly committed transactions, a loss

in fair value for those instruments is generally offset by increases in the value of the underlying exposure. Foreign currency

fluctuations did not have a material impact on the Company's results of operations and financial position during fiscal years 2001,

2000 and 1999.

Investments

The fair value of the Company's cash equivalents and short- and long-term investments at February 2, 2001, was approximately

$6 billion (excluding equity securities). The Company's investment policy is to manage its investment portfolio to preserve principal

and liquidity while maximizing the return on the investment portfolio through the full investment of available funds. The Company