Cracker Barrel 2015 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2015 Cracker Barrel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

leverage ratio is 3.00 to 1.00 or less and (2) in an aggregate

amount not to exceed $100,000 in any scal year if our

consolidated total leverage ratio is greater than 3.00 to 1.00 at

the time the dividend or repurchase is made; notwithstanding

(1) and (2), so long as immediately aer giving eectto the

payment of any such dividends, cash availability is at least

$100,000, we may declareand pay cash dividends on sharesof

our common stock in an aggregate amount not to exceed in

any scal year the product of the aggregate amount of dividends

declared in the fourth quarter of the immediately preceding

scal year multiplied by four.

During each of the rstthree quarters of 2015, we declared

a regular quarterly dividend of $1.00 per shareof our

common stock. Additionally, during the fourth quarter of

2015, we increased our regularquarterly dividend by 10% by

declaring a dividend of $1.10 per shareand declareda special

dividend of $3.00 per share, both payable on August 5, 2015

to shareholdersof record on July 17, 2015.

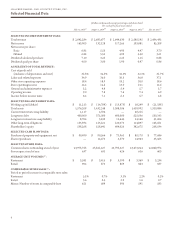

e following table highlights the dividends per sharewe

paid for the last three years:

2015 2014 2013

Dividends per share paid $4.00 $3.00 $1.90

Our current criteria for share repurchases are that they be

accretive to expected net income per share andare within the

limits imposed by our Revolving Credit Facility. Subjectto

the limits imposed by the Revolving Credit Facility and Prior

CreditFacility, in 2015, 2014 and 2013, we were authorized

by our Boardof Directors to repurchase shares at the

discretion of management up to $25,000, $50,000 and

$100,000, respectively. On September 25, 2015, our Boardof

Directors extended the $25,000 repurchase authorization for

an additional year.

e following table highlights our share repurchases for the

last three years:

2015 2014 2013

Sharesof common stock

repurchased — 120,000 44,300

Cost of sharesrepurchased $ — $ 12,473 $3,570

In 2015 and 2014, relatedtax withholding paymentson

certain share-based compensation awards exceeded proceeds

received from the exercise of stock options which resulted

in a net use of cash of $4,816 and $8,457, respectively. In 2013,

proceedsreceived from the exercise of share-based compen-

sation awards were $6,454.

Working Capital

In the restaurant industry, substantially all sales are either for

cash or third-party creditcard. Like many other restaurant

companies, we are able to, and oen do, operate with negative

working capital. Restaurant inventories purchased through our

principal food distributor are on termsof net zerodays, while

other restaurant inventories purchased locally are generally

nancedthrough trade creditat terms of 30 days or less.

Because of our gi shop, which has a lower product turnover

than the restaurant,we carry larger inventories than many other

companies in the restaurant industry. Retail inventories are

generally nancedthrough trade creditat terms of 60 days or

less. esevarious trade termsare aided by rapid turnoverof

the restaurant inventory.Employees generally are paid on

weeklyor semi-monthly schedules in arrears for hours worked

except for bonuses that are paid either quarterly or annually in

arrears. Many other operating expenses have normal trade

terms andcertain expenses such as certain taxes and some

benets are deferred for longer periods of time.

e following table highlights our working capital:

2015 2014 2013

Working capital (decit) $11,213 $(14,789) $(13,873)

e changein working capital at July 31, 2015 compared

to August 1, 2014 primarily reected an increase in cash from

operations partially oset by an increase in our dividend

payable, the timingof payments for accounts payable and

lower retail inventories. e changein working capital at

August 1, 2014 comparedto August 2, 2013 primarily

reected our current maturities on our debt, the increase in

our dividend payable, an increase in deferred revenuerelated

to the sales of our gi cards andthe current portion of our

16