Cracker Barrel 2015 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2015 Cracker Barrel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Total revenue benetedfrom the opening of 6, 7 and 8 new

storesin 2015, 2014 and 2013, respectively.

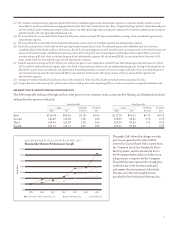

e following table highlights comparablestore sales* results

over the past two years:

Period to Period Increase

2015 vs 2014 2014 vs 2013

(621 Stores) (609 Stores)

Restaurant 5.1% 0.7%

Retail3.6 0.4

Restaurant & Retail 4.8 0.6

*Comparable storesales consist of sales of stores open at least six full

quarters at the beginningof the year andare measuredon comparable

calendar weeks.

Our comparablestore restaurant sales increase from2014

to 2015 resultedfrom a higher average check of 3.0%,

primarily aributableto a 2.5% average menu price increase

andan increase in guest trac of 2.1%. Our comparable store

restaurant sales increase from2013 to 2014 resulted from a

higher average check of 2.6%, primarily aributableto a 2.1%

average menu price increase, partially oset by a decrease in

guest trac of 1.9%.

e comparablestore retail sales increase from2014 to

2015 resultedprimarily from strong performance in apparel

andaccessories, bed and bathand home décormerchandise

categories and the increase in guest trac. e comparable

store retailsales increasefrom 2013 to 2014 resulted primarily

from strong performance in apparel and accessories and home

décor merchandise categories partially oset by a decline

in the bed and bathmerchandise category andthe decrease in

guest trac.

Cost of Goods Sold (Exclusive of Depreciation andRent)

e following table highlights the componentsof cost of goods

soldin dollaramounts for the past three years:

2015 2014 2013

Cost of Goods Sold:

Restaurant $630,417 $589,390 $571,825

Retail293,754 283,368 282,859

Total Cost of Goods Sold $924,171 $872,758 $854,684

e following table highlights restaurant cost of goods sold

as a percentage of restaurant revenuefor the past three years:

2015 2014 2013

Restaurant Cost of Goods Sold27.8% 27.6% 27.2%

e modest increase from2014 to 2015 was the result of

food commodity ination of 2.7% and a shito higher cost

menu items partially oset by our menu price increase

referenced above andlower food waste.Higher cost menu

items andlower food waste accounted for 0.2% and 0.1%,

respectively, in restaurant cost of goods soldas a percentage of

restaurant revenue.e increase from2013 to 2014 was

primarily the result of food commodity ination of 1.8%, a

shito highercost menu items andhigherfood waste

partially oset by our menu price increase referenced above.

Higher cost menu items andhigher food waste accounted

for 0.3% and 0.1%, respectively, in restaurant cost of goods

soldas a percentage of restaurant revenue.

We presently expect the rate of commodity ination to be

approximately3.0% to 4.0% in 2016 as comparedto 2015.

We expect to partially oset the eects of food commodity

ination through a combination of menu price increases,

supplycontracts and other cost reduction initiatives.

e following table highlights retail cost of goods soldas a

percentage of retail revenue for the past three years:

2015 2014 2013

Retail Cost of Goods Sold 51.3% 51.9% 52.4%

e decrease in retail cost of goods soldas a percentage of

retail revenuein 2015 as compared to 2014 resulted primarily

from lower markdownsand lower freight expense.

2014 to 2015

(Decrease) as a Percentage

of Total Revenue

Markdowns(0.3%)

Freight (0.2%)

e decrease in retail cost of goods soldas a percentage of

retail revenuein 2014 as compared to 2013 resulted primarily

from lower freight, higher initial markup on retail merchandise,

lower shrinkageand a reductionin the obsolescence inventory

reserve partially oset by higher markdowns.

11