Cracker Barrel 2015 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2015 Cracker Barrel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

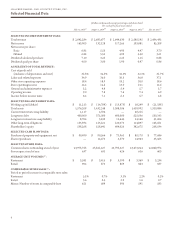

Interest Expense

e following table highlights interest expense for the past

three years:

2015 2014 2013

Interest expense $16,679 $17,557 $35,742

e year-to-year decrease from 2014 to 2015 resulted

primarily from lower weighted average interest rates partially

oset by the write-oof $412 in deferred nancing costs as

a result of our debt renancing. See the discussion below

under “Borrowing Capacity and DebtCovenants” for further

information on our debt renancing. We presently expect

interest expense for 2016 to be approximately $14,000 to

$15,000.

e year-to-year decrease from 2013 to 2014 resulted

primarily from lower interest rates because of the expiration

of our seven-year interest rate swap on May 3, 2013, which

had a xed interestrate of 5.57% plus our credit spread,and

lower debt outstanding.

Provision for Income Taxes

e following table highlights the provision for income taxes

as a percentage of income before income taxes (“eective tax

rate”)for the past three years:

2015 2014 2013

Eective tax rate 31.2% 30.8% 29.3%

e increase in our eective tax rate from 2014 to 2015

resulted primarily from lower employer taxcredits as a

percent of income before taxes. e increase in our eective

taxrate from 2013 to 2014 resulted primarily from the

expiration of the Work Opportunity Tax Credit (“WOTC”)

as of December 31, 2013.

We presently expect our eective tax rate for 2016 to be

between 32% and 33%. is estimate assumes that the

WOTC, which expired on December 31, 2014, is not renewed.

We estimate that the renewal of the WOTC could reduce

our provision for income taxes by $3,500 to $6,500 in 2016.

LIQUIDITY AND CAPITAL RESOURCES

e following table presents a summaryof our cash owsfor

the last three years:

2015 2014 2013

Netcash provided by operating

activities $334,055 $177,625 $208,499

Netcash used in investing

activities(88,614) (88,815) (73,406)

Netcash used in nancing

activities(99,347) (91,167) (165,337)

Netincrease (decrease) in cash

andcash equivalents $146,094 $(2,357) $(30,244)

Our primary sources of liquidity are cash generated from

our operationsandour borrowingcapacity underour

revolving credit facility.Our internally generated cash, along

with cash on handat August 1, 2014, was sucient to nance

allof our growth, dividend payments, working capital needs

andother cash payment obligations in 2015.

We believe that cash at July 31, 2015, along with cash

expected to be generated from our operating activities and

the borrowing capacity under our revolving creditfacility

will be sucient to nance our continuing operations, our

continuing expansion plansand our expected dividend

payments for 2016.

Cash Generatedfrom Operations

e increase in net cash ow provided by operating activities

from 2014 to 2015 reected lower annual and long-term

incentive bonus paymentsmade in 2015 as a result of the prior

year’sperformance, the timing of paymentsfor accounts

payable, higher net income and lower retail inventories. Lower

retail inventories resultedfrom improved buying strategies,

fewer receipts of holiday merchandise andbeer general

inventory management.e decrease in net cash ow provided

by operating activities from2013 to 2014 reected the timing

of paymentsfor accountspayable and higher retail inventories.

Higher retail inventories at the end of 2014 resultedprimarily

from the early receipt of holiday andother merchandise and

lower than anticipatedsales in 2014.

14