Cracker Barrel 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 Cracker Barrel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3) Apply technology and processenhancements to drive

store operating margins. We successfully implemented

new technology and process improvements to reduce

annual operating costs by approximately $20,000

annualized. ese improvements and initiatives included

plate reduction, retail labor scheduling and lighting

enhancement. Our new plate reduction guidelines drove

improvements in dish room labor and chemical usage

costs. Annual savings were also realizedthrough a

system-wide update to our retail labor scheduling and a

re-bulbing of all stores with new LED light technology.

We believe these initiativesfurther droveretail produc-

tivity and reduced our utilities expense,respectively,

while maintaining the overall guest experience. It is our

belief that these 2015 initiativesgenerated sustainable

improvements in our cost structure and drove higher

operating margins.

4) Continue thegrowthof the brand by developingand

opening new stores. During 2015, we opened six new

Cracker Barrel Old Country Store locations, including

one designed with our new store prototype, expanding

our chain to 637 stores in 42 states at year-end. We were

pleased with guests’ responses to our new prototype

design. As we gain knowledge from the performance of

our new prototype, we anticipate retrot opportunities

for individual initiativesthat can benet the performance

of our existing stores.

We believe the successful implementation of these four

priorities contributedto our revenuegrowthduring the year,

positive comparablestore restaurant andretail sales for the

year and higher operating marginand prot as compared to

the prior year.

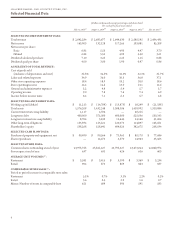

RESULTS OF OPETIONS

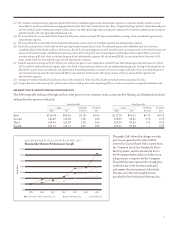

e following table highlights operating results over the past

three years: Relationship to Total Revenue

2015 2014 2013

Total revenue 100.0% 100.0% 100.0%

Cost of goods sold(exclusive of

depreciation and rent)32.5 32.5 32.3

Labor and other relatedexpenses 34.9 36.0 36.5

Other store operating expenses 18.4 18.9 18.2

Store operating income 14.2 12.6 13.0

General and administrative 5.2 4.8 5.4

Operating income 9.0 7.8 7.6

Interest expense 0.6 0.7 1.3

Income before income taxes8.4 7.1 6.3

Provision for income taxes 2.6 2.2 1.9

Netincome 5.8 4.9 4.4

Total Revenue

e following table highlights the key components of revenue

for the past three years:

2015 2014 2013

Revenuein dollars:

Restaurant $2,269,610 $2,137,405 $2,104,768

Retail572,674 546,272 539,862

Total revenue $2,842,284 $2,683,677 $2,644,630

Total revenue percentage

increase5.9% 1.5% 2.5%

Total revenue by percentage

relationships:

Restaurant 79.9% 79.6% 79.6%

Retail20.1% 20.4% 20.4%

Comparable number of stores 621 609 596

Comparable store averages

per store:

Restaurant $ 3,569 $3,422 $3,409

Retail894 871 871

Total $4,463 $4,293 $4,280

Restaurant average

weeklysales(1) $68.9 $65.7 $65.2

Retail averageweekly sales(1) 17.4 16.8 16.7

(1) Average weekly sales are calculated by dividing netsales by operating

weeks andinclude all stores.

10