Cracker Barrel 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Cracker Barrel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

čģÒ

ħÃÃďY¶=ÚÊòĄ

Over ÿģģ locations in č States

%+<B&%BB5(9LQGG 30

Next Exit

Table of contents

-

Page 1

ħÃÃÄY ÄÄ£Ã'Âœ Next Exit Over ÿģģ locations in ÂŸÄ States -

Page 2

... build-out of our Wholesome Fixin's® menu category. This category was added to our core menu in August 2013 to meet our guests' desire for additional better-for-you menu items. In 2015, we broadened the category offerings to include entrees like our Southern Grilled Chicken Caesar Salad and Apple... -

Page 3

... drove improvements in dish room labor and chemical usage costs. Annual savings were also realized through a system-wide update to our retail labor scheduling and a re-bulbing of all stores with new LED light technology. We believe these initiatives further drove retail productivity and reduced our... -

Page 4

... and CEO of Cracker Barrel Old Country Store, Inc. Glenn A. Davenport President of G. A. Food Service, Inc.; former Chairman and CEO of Morrison Management Specialists Richard J. Dobkin Retired; former Managing Partner of the Tampa, FL ofï¬ce of Ernst & Young, LLP Norman E. Johnson Retired... -

Page 5

...Selected Financial Data Shareholder Return Performance Graph Management's Discussion and Analysis of Financial Condition and Results of Operations Management's Report on Internal Control Over Financial Reporting Report Of Independent Registered Public Accounting Firm Report Of Independent Registered... -

Page 6

... information, many of the ma ers discussed in this Annual Report to Shareholders may express or imply projections of items such as revenues or expenditures, estimated capital expenditures, compliance with debt covenants, plans and objectives for future operations, store economics, inventory... -

Page 7

... business continuity plan following a major disaster at or near our corporate facility could adversely a ect our business. • Our ability to manage our retail inventory levels and changes in merchandise mix may adversely a ect our business. • A material disruption in our information technology... -

Page 8

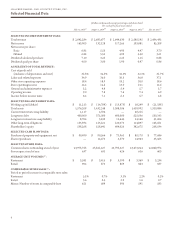

... liability Long-term debt Long-term interest rate swap liability Other long-term obligations Shareholders' equity SELECTED CASH FLOW DATA: Purchase of property and equipment, net Share repurchases SELECTED OTHER DATA: $ $ Common shares outstanding at end of year Stores open at end of year AVE GE... -

Page 9

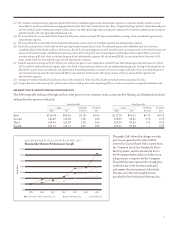

...T RY STOR E , I NC. Shareholder Return Performance Graph $700 $600 $500 $400 $300 $200 $100 $0 2009 2010 2011 2012 2013 2014 2015 e graph (le ) shows the changes over the past six-year period in the value of $100 invested in Cracker Barrel Old Country Store, Inc. Common Stock, the Standard & Poor... -

Page 10

...in the operation and development of the Cracker Barrel Old Country Store® ("Cracker Barrel") concept. Each Cracker Barrel store consists of a restaurant with a gi shop. e restaurants serve breakfast, lunch and dinner. e gi shop area o ers a variety of decorative and functional items specializing in... -

Page 11

... be er-foryou menu items, we continued the build-out of our Wholesome Fixin's menu category throughout 2015. Our retail gi shop continues to be an integral part of the Cracker Barrel experience. Our merchandising team sourced themes that are designed to work across multiple demographics and resonate... -

Page 12

... drove improvements in dish room labor and chemical usage costs. Annual savings were also realized through a system-wide update to our retail labor scheduling and a re-bulbing of all stores with new LED light technology. We believe these initiatives further drove retail productivity and reduced our... -

Page 13

... of sales of stores open at least six full quarters at the beginning of the year and are measured on comparable calendar weeks. Our comparable store restaurant sales increase from 2014 to 2015 resulted from a higher average check of 3.0%, primarily a ributable to a 2.5% average menu price increase... -

Page 14

... Store hourly labor Employee health care expenses Store management compensation Payroll taxes Store bonus expense (0.6%) (0.3%) (0.3%) (0.2%) 0.4% e decrease in store hourly labor costs as a percentage of total revenue from 2014 to 2015 resulted from menu price increases being greater than wage... -

Page 15

...1 of this Annual Report on Form 10-K for further information related to the FLSA litigation. In 2014, we incurred $4,313 in costs related to a proxy contest at our Annual Shareholders Meeting and a Special Meeting of Shareholders. e year-to-year percentage change from 2013 to 2014 resulted primarily... -

Page 16

... improved buying strategies, fewer receipts of holiday merchandise and be er general inventory management. e decrease in net cash ow provided by operating activities from 2013 to 2014 re ected the timing of payments for accounts payable and higher retail inventories. Higher retail inventories at the... -

Page 17

... insurance recoveries $90,490 $90,564 $73,961 Our capital expenditures consisted primarily of costs of new store locations and capital expenditures for maintenance programs. Capital expenditures were relatively at in 2015 as compared to 2014. e increase in capital expenditures from 2013 to 2014... -

Page 18

..., the timing of payments for accounts payable and lower retail inventories. e change in working capital at August 1, 2014 compared to August 2, 2013 primarily re ected our current maturities on our debt, the increase in our dividend payable, an increase in deferred revenue related to the sales of... -

Page 19

...demands and promotional calendar changes, our best estimate of usage for food, supplies and other operating needs and services is ratably over either the notice period or the remaining life of the contract, as applicable, unless we had be er information available at the time related to each contract... -

Page 20

... for Asset Dispositions • Insurance Reserves • Retail Inventory Valuation • Tax Provision • Share-Based Compensation • Legal Proceedings Management has reviewed these critical accounting estimates and related disclosures with the Audit Commi ee of our Board of Directors. Impairment of Long... -

Page 21

... of our fully-insured health insurance plans for calendar 2013 and 2014 contained a retrospective feature which could increase or decrease premiums based on actual claims experience. Our accounting policies regarding insurance reserves include certain actuarial assumptions and management judgments... -

Page 22

... tax rates, employer tax credits for items such as FICA taxes paid on employee tip income and the Work Opportunity credit, as well as estimates related to certain depreciation and capitalization policies. Our estimates are made based on current tax laws, the best available information at the time... -

Page 23

...addition to providing the requisite service, MSU Grants contain both a market condition, total shareholder return, and a performance condition. Total shareholder return is de ned as the change in our stock price plus dividends paid during the performance period. e number of shares awarded at the end... -

Page 24

...by market conditions, weather, production problems, delivery di culties and other factors which are outside our control and which are generally unpredictable. e following table highlights the ve food categories which accounted for the largest shares of our food purchases in 2015 and 2014: Percentage... -

Page 25

... on our website. ey set the tone for our organization and include factors such as integrity and ethical values. Our internal control over nancial reporting is supported by formal policies and procedures, which are reviewed, modi ed and improved as changes occur in business conditions and operations... -

Page 26

...OLD COUN T RY STOR E , I NC. Report Of Independent Registered Public Accounting Firm To the Board of Directors and Shareholders of Cracker Barrel Old Country Store, Inc. Lebanon, Tennessee We have audited the accompanying consolidated balance sheets of Cracker Barrel Old Country Store, Inc. and its... -

Page 27

... OLD COUN T RY STOR E , I NC. Report Of Independent Registered Public Accounting Firm To the Board of Directors and Shareholders of Cracker Barrel Old Country Store, Inc. Lebanon, Tennessee We have audited the internal control over nancial reporting of Cracker Barrel Old Country Store, Inc. and its... -

Page 28

... Shareholders' Equity: Preferred stock - 100,000,000 shares of $.01 par value authorized; 300,000 shares designated as Series A Junior Participating Preferred Stock; no shares issued Common stock - 400,000,000 shares of $.01 par value authorized; 2015 - 23,975,755 shares issued and outstanding; 2014... -

Page 29

...NC. Consolidated Statements of Income (In thousands except share data) July 31, 2015 Fiscal years ended August 1, 2014 August 2, 2013 Total revenue Cost of goods sold (exclusive of depreciation and rent) Labor and other related expenses Other store operating expenses Store operating income General... -

Page 30

... for employee taxes 145,900 Tax bene t realized upon exercise of share-based compensation awards Purchases and retirement of common stock (120,000) Balances at August 1, 2014 23,821,227 Comprehensive Income: Net income Other comprehensive income, net of tax Total comprehensive income Cash dividends... -

Page 31

...t from share-based compensation Changes in assets and liabilities: Accounts receivable Income taxes receivable Inventories Prepaid expenses and other current assets Other assets Accounts payable Taxes withheld and accrued Accrued employee compensation Accrued employee bene ts Deferred revenues Other... -

Page 32

... depreciation expense related to store operations for each of the three years are as follows: 2015 2014 2013 e Company's policy is to consider all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. Accounts receivable - Accounts receivable... -

Page 33

... relative to its outstanding borrowings, which bear interest at the Company's election either at the prime rate or LIBOR plus a percentage point spread based on certain speci ed nancial ratios under its credit facility (see Note 5). e Company's policy has been to manage interest cost using a mix of... -

Page 34

... calendar 2013 and 2014 health insurance program contains a retrospective feature which could increase or decrease premiums based on actual claims experience. Store pre-opening costs - Start-up costs of a new store are expensed when incurred, with the exception of rent expense under operating leases... -

Page 35

... the rst time the advertising takes place. Other advertising costs are expensed as incurred. Advertising expense for each of the three years was as follows: 2015 2014 2013 includes employer tax credits for FICA taxes paid on employee tip income and other employer tax credits are accounted for by... -

Page 36

weighted average number of common and common equivalent shares outstanding during the year. Common equivalent shares related to stock options, nonvested stock awards and MSU Grants issued by the Company are calculated using the treasury stock method. Outstanding employee and director stock options, ... -

Page 37

... is also considered a Level 2 input. e fair values of accounts receivable and accounts payable at July 31, 2015 and August 1, 2014, approximate their carrying amounts because of their short duration. value of the Company's variable rate debt, based on quoted market prices, which are considered Level... -

Page 38

... at least $100,000 (the "cash availability"), the Company may declare and pay cash dividends on shares of its common stock and repurchase shares of its common stock (1) in an unlimited amount if at the time such dividend or repurchase August 1, 2014 Retail Restaurant Supplies Total $115,777 22,212... -

Page 39

... plus the Company's credit spread. e Company's credit spreads at July 31, 2015 and August 1, 2014 were 1.25% and 1.50%, respectively. All of the Company's interest rate swaps are accounted for as cash ow hedges. A summary of the Company's interest rate swaps at July 31, 2015 is as follows: Trade... -

Page 40

...respects. Accordingly, the Company manages its business on the basis of one reportable operating segment. All of the Company's operations are located within the United States. Total revenue was comprised of the following at: 2015 2014 2013 Cash ow hedges: Interest rate swaps Interest expense $8,052... -

Page 41

..., 2015, the Company operated 220 stores in leased facilities and also leased certain land, a retail distribution center and advertising billboards. Rent expense under operating leases, including the sale-leaseback transactions discussed below, for each of the three years was: Year Minimum Contingent... -

Page 42

... and will vest at the end of the applicable three-year performance period for each annual plan is based on total shareholder return, which is de ned as the change in the Company's stock price plus dividends paid during the performance period. e number of shares awarded at the end of the performance... -

Page 43

... three years: 2015 2014 2013 Total intrinsic values of options exercised* $4,652 $169 $10,526 * e intrinsic value for stock options is de ned as the di erence between the current market value and the grant price. Dividend yield*** Expected volatility Risk-free interest rate range 21% 1.0% 25... -

Page 44

... awards was $4,705. 11 SHAREHOLDER RIGHTS PLAN On April 9, 2015, the Company's Board of Directors declared a dividend of one preferred share purchase right (a "Right") for each outstanding share of common stock, par value $0.01 per share, and adopted a shareholder rights plan, as set forth in the... -

Page 45

... be to receive the redemption price of $0.01 per Right. split or stock dividends of its common stock. Qualifying O er Provision e Rights would also not interfere with all-cash, fully nanced tender o ers for all shares of common stock that remain open for a minimum of 60 business days, are subject to... -

Page 46

... each of the three years: 2015 2014 2013 12 EMPLOYEE SAVINGS PLANS e Company sponsors a quali ed de ned contribution retirement plan ("401(k) Savings Plan") covering salaried and hourly employees who have completed ninety days of service and have a ained the age of twenty-one. of their compensation... -

Page 47

...e ective tax rate for each of the three years: 2015 2014 2013 Deferred tax assets: Compensation and employee bene ts Deferred rent Accrued liabilities Insurance reserves Inventory Other Deferred tax assets Deferred tax liabilities: Property and equipment Inventory Other Deferred tax liabilities Net... -

Page 48

... the Fair Labor Standards Act ("FLSA"). e Company has recorded a total provision of approximately $3,500 at July 31, 2015 to re ect the liability related to these lawsuits. Although we continue to believe that the Company's associate managers are and have been properly classi ed as exempt employees... -

Page 49

... primary obligor under such lease agreement. e Company enters into certain indemni cation agreements in favor of third parties in the ordinary course of business. At August 1, 2014 and July 31, 2015, the Company recorded a liability related to legal costs. e Company believes that the amount recorded... -

Page 50

... Vice President, Restaurant Operations Sherri Moore Vice President, Restaurant and Retail Operations Support Michael W. Mo Vice President, Human Resources Ben Noyes Regional Vice President, Restaurant Operations omas R. Pate Vice President, Training and Management Development William M. Prentice... -

Page 51

... Corporate Ofï¬ces Cracker Barrel Old Country Store, Inc. P.O. Box 787 305 Hartmann Drive Lebanon, TN 37088-0787 Phone: 615-444-5533 crackerbarrel.com Transfer Agent American Stock Transfer & Trust Company 59 Maiden Lane Plaza Level New York, NY 10038 Independent Registered Public Accounting... -

Page 52

CRACK ER BAR REL OL D COUN TRY ST ORE, IN P.O. BO C. X 787 LEBANO N, TN 3 7088-0 CRACKE 787 RBARRE L.COM