Columbia Sportswear 2002 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2002 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

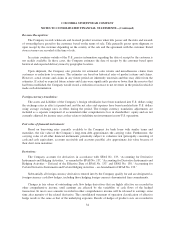

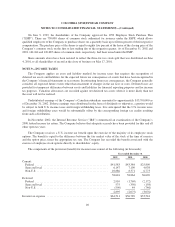

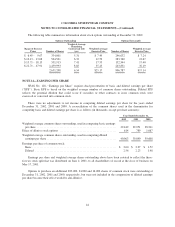

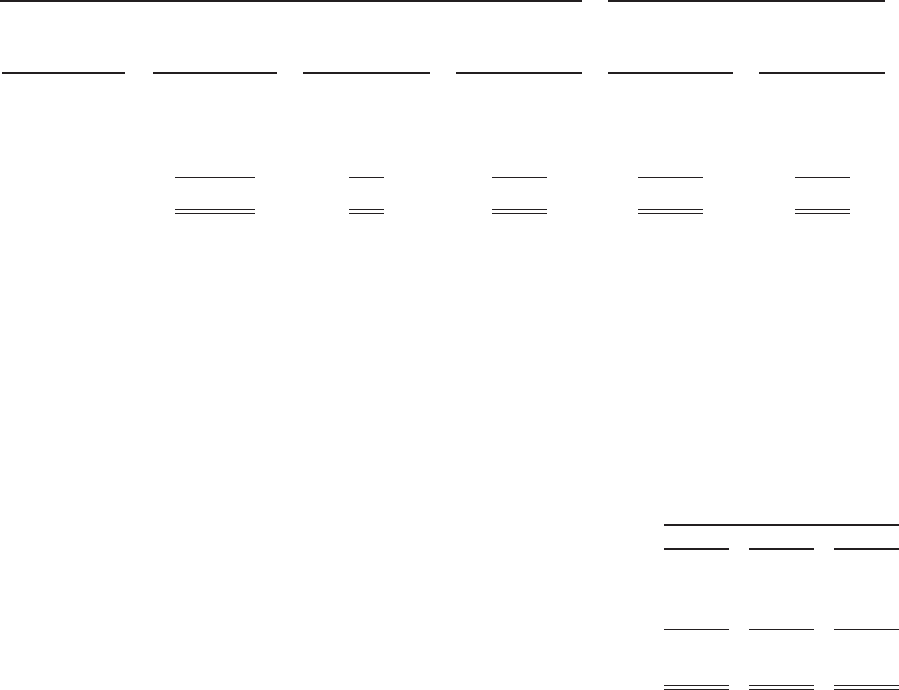

The following table summarizes information about stock options outstanding at December 31, 2002:

Options Outstanding Options Exercisable

Range of Exercise

Prices Number of Shares

Weighted Average

Remaining

Contractual Life

(yrs)

Weighted Average

Exercise Price Number of Shares

Weighted Average

Exercise Price

$ 6.45 - 9.67 334,801 5.31 $ 7.49 246,632 $ 7.24

$ 10.13 - 13.08 504,501 6.32 12.52 283,760 12.67

$ 15.71 - 18.13 351,913 7.41 17.55 132,544 17.40

$ 22.71 - 47.91 1,459,993 8.85 35.43 243,851 32.19

2,651,208 6.54 $25.17 906,787 $17.14

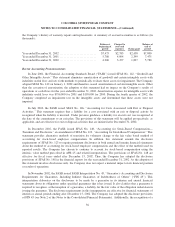

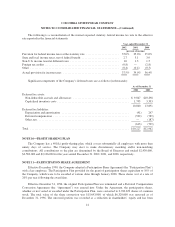

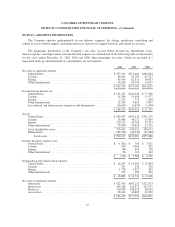

NOTE 14—EARNINGS PER SHARE

SFAS No. 128, “Earnings per Share” requires dual presentation of basic and diluted earnings per share

(“EPS”). Basic EPS is based on the weighted average number of common shares outstanding. Diluted EPS

reflects the potential dilution that could occur if securities or other contracts to issue common stock were

exercised or converted into common stock.

There were no adjustments to net income in computing diluted earnings per share for the years ended

December 31, 2002, 2001 and 2000. A reconciliation of the common shares used in the denominator for

computing basic and diluted earnings per share is as follows (in thousands, except per share amounts):

Year Ended December 31,

2002 2001 2000

Weighted average common shares outstanding, used in computing basic earnings

pershare ........................................................ 39,449 39,051 38,541

Effect of dilutive stock options ........................................ 614 789 1,067

Weighted-average common shares outstanding, used in computing diluted

earnings per share ................................................. 40,063 39,840 39,608

Earnings per share of common stock:

Basic ........................................................... $ 2.60 $ 2.27 $ 1.52

Diluted ......................................................... 2.56 2.23 1.48

Earnings per share and weighted average shares outstanding above have been restated to reflect the three-

for-two stock split that was distributed on June 4, 2001, to all shareholders of record at the close of business on

May 17, 2001.

Options to purchase an additional 839,000, 34,000 and 16,000 shares of common stock were outstanding at

December 31, 2002, 2001 and 2000, respectively, but were not included in the computation of diluted earnings

per share because their effect would be anti-dilutive.

44