Columbia Sportswear 2002 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2002 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

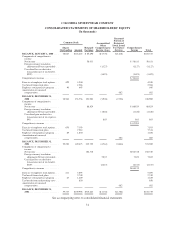

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

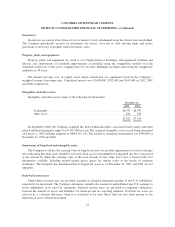

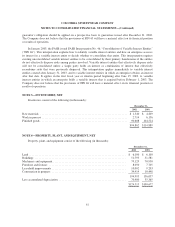

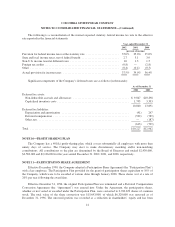

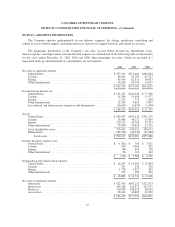

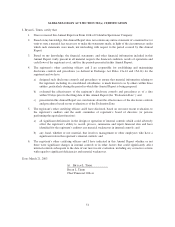

The following is a reconciliation of the normal expected statutory federal income tax rate to the effective

rate reported in the financial statements:

Year ended December 31

2002 2001 2000

(percent of income)

Provision for federal income taxes at the statutory rate ....................... 35.0% 35.0% 35.0%

State and local income taxes, net of federal benefit .......................... 2.7 3.1 3.0

Non-U.S. income taxed at different rates .................................. 1.0 1.3 1.5

Foreign tax credits .................................................... (0.8) — (2.8)

Other .............................................................. (0.4) (0.4) (0.3)

Actual provision for income taxes ....................................... 37.5% 39.0% 36.4%

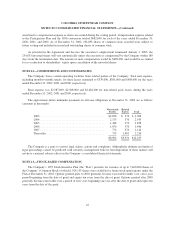

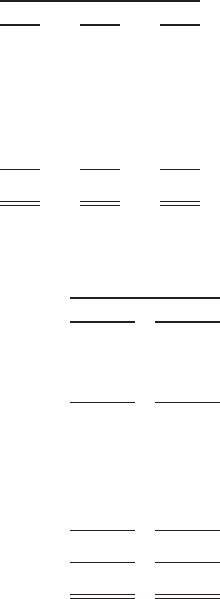

Significant components of the Company’s deferred taxes are as follows (in thousands):

As of December 31

2002 2001

Deferred tax assets:

Non-deductible accruals and allowances ....................................... $ 9,047 $10,298

Capitalized inventory costs .................................................. 1,793 3,393

10,840 13,691

Deferred tax liabilities:

Depreciation and amortization ............................................... (91) 247

Deferred compensation ..................................................... (522) (789)

Other,net................................................................ — (187)

(613) (729)

Total ..................................................................... $10,227 $12,962

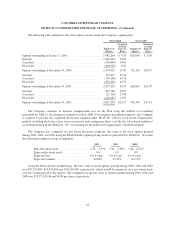

NOTE 10—PROFIT SHARING PLAN

The Company has a 401(k) profit-sharing plan, which covers substantially all employees with more than

ninety days of service. The Company may elect to make discretionary matching and/or non-matching

contributions. All contributions to the plan are determined by the Board of Directors and totaled $2,930,000,

$2,582,000 and $2,106,000 for the years ended December 31, 2002, 2001, and 2000, respectively.

NOTE 11—PARTICIPATION SHARE AGREEMENT

Effective December 1990, the Company adopted a Participation Share Agreement (the “Participation Plan”)

with a key employee. The Participation Plan provided for the grant of participation shares equivalent to 10% of

the Company, which were to be awarded at various dates through January 2000. These shares vest at a rate of

20% per year following the award date.

Effective December 31, 1996, the original Participation Plan was terminated and a Deferred Compensation

Conversion Agreement (the “Agreement”) was entered into. Under the Agreement, the participation shares,

whether or not vested or awarded under the Participation Plan, were converted to 2,700,653 shares of common

stock. The total value of the share conversion was $15,693,000, of which $6,320,000 was unvested as of

December 31, 1996. The unvested portion was recorded as a reduction in shareholders’ equity and has been

41