Columbia Sportswear 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

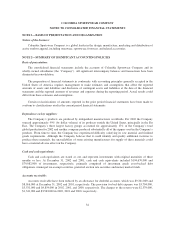

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Inventories:

Inventories are carried at the lower of cost or market. Cost is determined using the first-in, first-out method.

The Company periodically reviews its inventories for excess, close-out or slow moving items and makes

provisions as necessary to properly reflect inventory value.

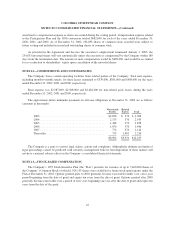

Property, plant, and equipment:

Property, plant, and equipment are stated at cost. Depreciation of machinery and equipment, furniture and

fixtures and amortization of leasehold improvements is provided using the straight-line method over the

estimated useful lives of the assets, ranging from 3 to 10 years. Buildings are depreciated using the straight-line

method over 30 years.

The interest-carrying costs of capital assets under construction are capitalized based on the Company’s

weighted average borrowing rates. Capitalized interest was $1,000,000, $792,000 and $145,000 in 2002, 2001

and 2000, respectively.

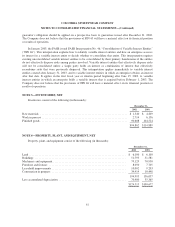

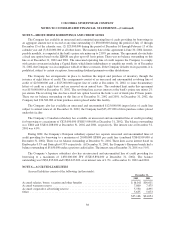

Intangibles and other assets:

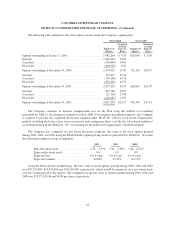

Intangibles and other assets consist of the following (in thousands):

December 31,

2002 2001

Trademarks .................................................. $6,971 $6,971

Other assets .................................................. 854 563

$7,825 $7,534

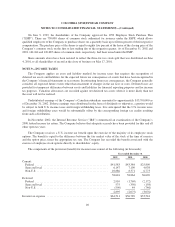

In September 2000, the Company acquired the Sorel trademark rights, associated brand names and other

related intellectual property rights for $7,967,000 in cash. The acquired intangible assets ceased being amortized

on January 1, 2002 with the adoption of SFAS No. 142. The related accumulated amortization was $996,000 at

December 31, 2002 and 2001.

Impairment of long-lived and intangible assets:

The Company evaluates the carrying value of long-lived assets for possible impairment as events or changes

arise indicating that such assets should be reviewed. If an asset is determined to be impaired, the loss is measured

as the amount by which the carrying value of the asset exceeds its fair value. Fair value is based on the best

information available, including quoted market prices, prices for similar assets or the results of valuation

techniques. The Company has determined that its long-lived assets as of December 31, 2002 and 2001 are not

impaired.

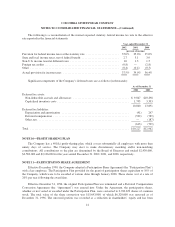

Deferred income taxes:

United States income taxes are provided currently on financial statement earnings of non-U.S. subsidiaries

expected to be repatriated. The Company determines annually the amount of undistributed non-U.S. earnings to

invest indefinitely in its non-U.S. operations. Deferred income taxes are provided for temporary differences

between the amount of assets and liabilities for financial and tax reporting purposes. Deferred tax assets are

reduced by a valuation allowance when it is estimated to be more likely than not that some portion of the

deferred tax assets will not be realized.

33