Bank of Montreal 2013 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2013 Bank of Montreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHIEF EXECUTIVE OFFICER’S MESSAGE

Bill Downe at the BMO Company Meeting, May 2013.

communications and instant access to information,

they assume an immediate response to their transactional

needs is always within reach. And as we in turn work

alongside them to help bring their financial goals within

reach, they want to see regular confirmation of the

value we add.

To deliver on these expectations, we’re asking more of

ourselves – and more of our bank.

There are big things going

on in our industry.

To say the changes underway around us are profound

isn’t an overstatement.

Profit models are changing across our industry, redefining

the drivers of success. Simultaneous shifts in consumer

behaviour and levels of regulatory engagement call for a

broad change agenda that speaks to both the growth of

revenue and the management of expense. There is a

premium on superb execution, on innovation and on agility

in delivering strong, consolidated financial performance.

The pace of change is very rapid for us all.

We take pride in the quality of the products and services

BMO offers to customers – they are the financial building

blocks of peace of mind: the control of spending, the

growth of savings, the prudent use of credit and wise

investment. We also care greatly about the way in which

customers experience our bank: responsiveness and

attention are what build trust and confidence for all customer

8 BMO Financial Group 196th Annual Report 2013

segments. But in an era of rapid social, technological and

economic change, we remain intensely focused on the

reason why our customers continue to look for our guidance

and support in controlling their financial futures. This is

something that goes far beyond convenience and product

features. It is why our bankers are so committed to the

work they do.

And we’re all confident it can be done better.

We’re confident in our ability to thrive in this period of

rapid change, because we’ve been steadily deepening our

long-standing focus on customers, building the capabilities

that grow loyalty and advocacy.

The forces of change

Against the broader backdrop of change, our efforts going

forward will be shaped by two significant forces:

• Customers’ growing appetite for personalized service,

in the moment. When someone has an experience that

is simpler or perfectly tailored to their needs in one area

of life, it influences their expectations in all other areas.

In a modern world, customers’ expectations of their bank

are being revised daily.

• An unprecedented level of regulatory engagement.

Around the globe, governments and supervisors are

introducing rigorous reporting requirements against

constantly evolving standards. To continue meeting them,

we must securely analyze highly complex data in real

time while simplifying the work of the bankers who are

responsible for understanding it. As we maintain this

balance, we’re guided by a long-held belief that what

matters more than any one rule is the larger reason

behind it. Effective regulation ensures integrity and

strengthens trust – principles that are vital to our success

as a business and have been ingrained in our values for

nearly 200 years.

In some ways these forces seem to operate in opposition

to one another. But we have confidence in our ability to

respond fully in each of the market segments we serve, and

to resolve the natural tension between simplifying the lives

of our customers and maintaining confidence in a financial

system that thrives in dealing with complex assignments.

Intensifying our efforts

In our four principal business groups we are meeting

the challenge of rising expectations. We know that in

making processes more efficient or services more accessible,

we create more opportunities for our employees to have

meaningful conversations with customers about their

financial goals, delivering the unique value that differentiates

our bank from our competitors.

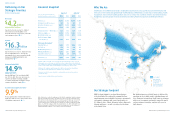

Personal and Commercial Banking finished the year

with very good momentum, reflecting the competitiveness

of BMO’s position in the markets we serve. In Canada,

where our commercial lending market share is close to

20%, we saw good balance growth: 12% in deposits

and 11% in loans. In personal banking we again led the

market with our emphasis on shorter-amortization,

fixed-rate mortgages.

In the U.S., mid-market commercial lending continued to

gain strength while initiatives targeted toward small business

customers gained traction. In U.S. retail banking we are

accelerating the move to digital fulfillment and sales while

increasing the investment in technology that supports

efficiency and growth.

BMO Capital Markets continued to demonstrate the simple

truth that a quality book of business generates quality

returns. We earned an 18.9% return on equity and were

named Best Investment Bank in Canada by Global Finance

magazine, and our strengthened U.S. business showed good

growth and improving operating leverage.

Wealth Management at BMO is distinguished by a superior

offering across multiple dimensions, from private banking

and asset management to brokerage and insurance. Market

momentum, growth created by changing demographics

and disciplined investment all support the accelerating

expansion of our wealth business.

Over the last decade, the bank has maintained strong

momentum in the compound growth rate of both revenue

and net income – 6% and 9%, respectively. With record

reported results in 2013 and the highest Basel III common

equity tier 1 ratio of the Canadian banks, BMO is well

positioned to capitalize on the opportunities ahead. We are

intensifying our pursuit of BMO’s five strategic priorities

(outlined on page 4) by focusing specifically in these areas:

• Extending the digital experience across all channels.

We’re developing strategies to further integrate the bank’s

digital and physical channels – merging the online and

mobile experience into our retail branch and ATM

network. U.S. households actively using BMO mobile

banking increased 60% in 2013.

• Simplifying and automating for greater efficiency.

By exploring new ways to streamline processes, modernize

platforms and embed cost controls, we’re adding to

the productivity and efficiency gains realized over the past

two years.

• Leveraging data insights to serve customers better.

By enhancing the bank’s analytics capabilities, we’re

sharpening our understanding of what customers

are looking for, how they want to do business with

us and, most importantly, why they need our help.

At BMO’s Meadowvale Customer Contact Centre, we pay close attention

to what’s on customers’ minds.

BMO Financial Group 196th Annual Report 2013 9