Bank of Montreal 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 Bank of Montreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Board of Directors1

To promote alignment of our strategic goals across all our businesses, each director sits on at least one board committee and the Chief

Executive Officer is invited to all committee meetings. We review the membership of all committees annually . www.bmo.com/corporategovernance

Robert M. Astley Janice M. Babiak

Sophie Brochu George A. Cope

William A. Downe Christine A. Edwards

Ronald H. Farmer Eric R. La Flèche

Bruce H. Mitchell Philip S. Orsino

Dr. Martha C. Piper

J. Robert S. Prichard

Don M. Wilson III

22 BMO Financial Group 196th Annual Report 2013

Robert M. Astley

Former President and Chief

Executive Officer, Clarica

Life Insurance Company, and

former President, Sun Life

Financial Canada

Board/Committees: Governance

and Nominating, Human

Resources (Chair), Risk Review

Director since: 2004

Janice M. Babiak

Corporate Director

Board/Committees: Audit and

Conduct Review, Risk Review

Other public boards: Royal

Mail plc, Walgreens Co.

Director since: 2012

Sophie Brochu

President and Chief Executive

Officer, Gaz Métro

Board/Committees: Audit

and Conduct Review

Other public boards: BCE Inc.

Director since: 2011

George A. Cope

President and Chief Executive

Officer, Bell Canada and BCE Inc.

Board/Committees: Human

Resources

Other public boards: BCE Inc.,

Bell Aliant

Director since: 2006

William A. Downe

Chief Executive Officer,

BMO Financial Group

Board/Committees: Attends

all committee meetings as

an invitee

Other public boards:

ManpowerGroup

Director since: 2007

Christine A. Edwards

Capital Partner, Winston & Strawn

Board/Committees: Human

Resources, Risk Review,

The Pension Fund Society

of the Bank of Montreal

Director since: 2010

Ronald H. Farmer

Managing Director,

Mosaic Capital Partners

Board/Committees: Audit and

Conduct Review, Governance and

Nominating, Human Resources,

The Pension Fund Society of the

Bank of Montreal (Chair)

Other public boards: Valeant

Pharmaceuticals International Inc.

Director since: 2003

Eric R. La Flèche

President and Chief Executive

Officer, Metro Inc.

Board/Committees: Risk Review

Other public boards: Metro Inc.

Director since: 2012

Bruce H. Mitchell

President and Chief Executive

Officer, Permian Industries Limited

Board/Committees: Audit and

Conduct Review, The Pension

Fund Society of the Bank of

Montreal

Director since: 1999

Philip S. Orsino, O.C., F.C.A.

President and Chief Executive

Officer, Jeld-Wen Inc.

Board/Committees: Audit

and Conduct Review (Chair),

Governance and Nominating

Director since: 1999

Dr. Martha C. Piper, O.C., O.B.C.

Corporate Director, former

President and Vice-Chancellor,

The University of British Columbia

Board/Committees: Audit and

Conduct Review, Governance

and Nominating (Chair)

Other public boards: Shoppers

Drug Mart Corporation, TransAlta

Corporation

Director since: 2006

J. Robert S. Prichard, O.C., O.Ont.

Chairman of the Board,

BMO Financial Group, and

Chair of Torys LLP

Board/Committees: Governance

and Nominating, Human

Resources, Risk Review,

The Pension Fund Society

of the Bank of Montreal

Other public boards: George

Weston Limited, Onex Corporation

Director since: 2000

Don M. Wilson III

Corporate Director

Board/Committees: Governance

and Nominating, Human

Resources, Risk Review (Chair)

Other public boards: Ethan

Allen Interiors Inc.

Director since: 2008

1

As at October 31, 2013.

Honorary Directors

Stephen E. Bachand, Ponte Vedra Beach, FL, USA

Ralph M. Barford, Toronto, ON

Matthew W. Barrett, O.C., LL.D., Oakville, ON

David R. Beatty, O.B.E., Toronto, ON

Peter J.G. Bentley, O.C., LL.D., Vancouver, BC

Robert Chevrier, F.C.A., Montreal, QC

Tony Comper, C.M., LL.D., Toronto, ON

Pierre Côté, C.M., Quebec City, QC

C. William Daniel, O.C., LL.D., Toronto, ON

Louis A. Desrochers, C.M., c.r., A.O.E., Edmonton, AB

A. John Ellis, O.C., LL.D., O.R.S., Vancouver, BC

John F. Fraser, O.C., LL.D., O.R.S., Winnipeg, MB

David A. Galloway, Toronto, ON

Richard M. Ivey, C.C., Q.C., Toronto, ON

Betty Kennedy, O.C., LL.D., Campbellville, ON

Harold N. Kvisle, Calgary, AB

Eva Lee Kwok, Vancouver, BC

J. Blair MacAulay, Oakville, ON

Ronald N. Mannix, O.C., Calgary, AB

Robert H. McKercher, Q.C., Saskatoon, SK

Eric H. Molson, Montreal, QC

Jerry E.A. Nickerson, North Sydney, NS

Jeremy H. Reitman, Montreal, QC

Lucien G. Rolland, O.C., Montreal, QC

Joseph L. Rotman, O.C., LL.D., Toronto, ON

Guylaine Saucier, F.C.P.A., F.C.A., C.M., Montreal, QC

Nancy C. Southern, Calgary, AB

CFO’S FOREWORD TO THE FINANCIAL REVIEW

CFO’s Foreword to the

Financial Review

Thomas E. Flynn

Chief Financial Officer, BMO Financial Group

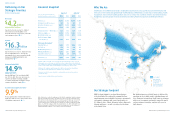

BMO delivered record net income of $4.2 billion in 2013,

building on our 2012 performance. On an adjusted basis, net

income rose to $4.3 billion and EPS was $6.30, increasing 5%

from last year. We also announced two dividend increases,

bought back over 10 million common shares and strengthened

our capital position.

Our continued good results reflect the success of our strategy

and have translated into attractive returns for BMO’s shareholders.

Our one-year total shareholder return of 29% was the highest

among our Canadian peer group. Over the past five years, our

shareholders have earned an average annual total shareholder

return of 17% on their investment in common shares. We have

achieved these returns while managing risk prudently and

strengthening our balance sheet.

The bank’s financial results are examined in Management’s

Discussion and Analysis (MD&A), where we review our

performance and tell our financial story clearly and thoroughly.

Our long-standing commitment to ensuring that shareholders

receive timely and informative reporting on our financial results

earned us the Chartered Professional Accountants of Canada

Award of Excellence in Corporate Reporting for Financial Services

in two of the last three years.

This year, we expanded our disclosures in several areas in

response to recommendations made by the Enhanced

Disclosure Task Force established by the Financial Stability

Board, which is part of a broader effort by industry participants

and regulators to strengthen the resiliency of the financial

services industry globally. We are supportive of this effort and

hope you find the additional disclosures informative.

Looking forward, we are well-positioned for the current

environment:

BMO Financial Group 196th Annual Report 2013 23

•

Our large North American commercial banking business is a

differentiator in an environment where commercial loan growth

is expected to continue to outpace consumer loan growth.

• Our flagship Canadian Personal and Commercial banking

business is heading into 2014 with good momentum.

• Wealth Management had record results for this year and

has good growth opportunities in North America and select

global markets.

• We expect growth and operating leverage from investments

we have made in our U.S. businesses and from the

improving U.S. economy.

• We are working to improve efficiency with an emphasis

on simplifying processes and pursuing opportunities to

integrate technology and operations infrastructures on a

North American basis.

• Our capital position is the strongest among our Canadian

peer group with a Basel III Common Equity Tier 1 Ratio of 9.9%,

up from the pro-forma estimate of 8.7% at the end of 2012.

As we head into 2014, we remain focused on meeting our

existing customers’ needs and adding new customers across

all our businesses by delivering on our brand promise.

We hope you enjoy reading our MD&A and look forward

to reporting on our continued progress next year.

Thomas E. Flynn