Bank of Montreal 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 Bank of Montreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BMO Financial Group 196th Annual Report 2013 3

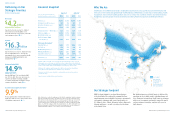

BMO AT A GLANCE

Delivering on Our

Strategic Priorities

2013 Performance

Net Income

$4.2 billion

Adjusted $4.3 billion

Reported net income rose by 1%. Adjusted

net income increased $0.2 billion or 5%.

The bank achieved record revenue, net income

and earnings per share. P 35

Revenue

$16.3 billion

Adjusted $15.6 billion

Reported revenue rose by 1%. Adjusted revenue

increased $0.5 billion or 3%. The increase

was primarily due to revenue growth in Wealth

Management, BMO Capital Markets and

Canadian P&C. P 38

Return on Equity (ROE)

14.9%

Adjusted 15.0%

Reported ROE was 15.9% and adjusted ROE

was 15.5% in 2012. There was an increase in

reported and adjusted earnings available

to common shareholders and higher average

common shareholders’ equity. P 36

Basel III Common Equity Tier 1 Ratio

9.9%

Strong capital position – Our Basel III Common

Equity Tier 1 Ratio of 9.9% is strong and in excess

of regulatory requirements. P 61

2 BMO Financial Group 196th Annual Report 2013

F

inancia

l

Sna

p

s

h

o

t

Re

p

orte

d

Adj

uste

d

1

As at or for the year ended October 3

1

(Canadian

$

in millions, except as noted)

20

1

3

16

,

26

3

58

9

10

,

29

7

4,

248

6.2

6

14.

9%

0

.2

%

9.9%

1,854

596

8

34

1,094

(

130)

4

,248

20

1

2

20

1

2

Revenue (p 38) 16

,

130 15

,

067

Provision for credit losses (p 42) 765 471

Non-interest expense (p 43) 10

,

238 9

,

513

Net income (p 35) 4

,

189 4

,

092

Earnin

g

s per share – diluted ($)

(

p 35

)

6.15 6.00

Return on equity (p 36

)

15.9% 15.5

%

Operatin

g

levera

g

e

(

p 43)

(

1.4

)

%

(

2.8

)%

Basel III Common Equity

Tier 1 Rati

o

2

(p 61) 8.7

%

8.7

%

Net Income by Segmen

t

3

Canadian P&C

(

p 47)

1

,

775

1,785

U

.S. P&C (p 50) 580 644

Wealth Management (p 53) 524

545

BMO Capital Markets (p 56

)

1,021 1,022

Corporate Services

4

(p 59

)

289 9

6

Net

i

ncome (p 35) 4,189 4,092

1

Ad

juste

d

resu

l

ts are non-GAAP an

d

are

d

iscusse

d

in t

h

e Non-GAAP Measures section on page 34.

M

anagement assesses performance on a GAAP basis and on an adjusted basis and considers both

t

o be useful in the assessment of underlying business performance. Presenting results on both

b

ases

p

rovides readers with an enhanced understanding of how management assesses results

.

2 Effective in 2013, regulatory capital requirements for BMO are determined on a Basel III basis.

In 2012, BMO

’

s Basel III capital ratios were calculated on a pro-forma basis

.

3

Certain

p

rior-

y

ear data has been reclassified to conform with the current

y

ear’s

p

resentation.

S

ee pages 44 and 45.

4

Corporate Services, including Technology and Operations

.

20

1

3

1

5

,

572

35

9

9

,

82

6

4,

27

6

6.3

0

1

5

.

0%

0

.1

%

9.9%

1

,864

64

6

8

61

1

,09

6

(

191)

4

,27

6

Bank of Montreal uses a unified branding approach that links the organization’s member companies

under the brand “BMO Financial Group”. Information about the intercorporate relationships among

Bank of Montreal and its principal subsidiaries is provided on page 189, which page is incorporated

herein by reference. These subsidiaries are incorporated under the laws of the state, province or

country in which their head or principal office is located with the exception of: BMO Harris Financial

Advisors, Inc., BMO (US) Lending, LLC, BMO Global Capital Solutions, Inc., BMO Capital Markets Corp.,

BMO Harris Financing, Inc., BMO Financial Corp., BMO Asset Management Corp., psps Holdings, LLC,

and BMO Capital Markets GKST Inc., each of which is incorporated in Delaware.

Who We Are

B

MO Financial Grou

p

196th Annual Re

p

ort 201

3

3

Core footprint

Other locations:

Wealth Management

U.S. Personal and

Commercial

BMO Capital Markets

BC

YT

NT

AB

SK

ON

QC

MB

NL

PE

NB

NS

NU

UT

CO

TX

WI

MN

FL

MO

KS

NE

GA

VA

NY MA

WA

OR

CA

IN

IL

AZ

Established in 1817, BMO Financial Group is a highly diversified financial services provider based in North America with

total assets of $537 billion and approximately 45,500 employees. BMO provides a broad range of retail banking, wealth

management and investment banking products and services to more than 12 million customers and conducts business

through three operating groups: Personal and Commercial Banking, Wealth Management and BMO Capital Markets.

Our Strategic Footprint

BMO’s strategic footprint is anchored by our business

in the heartland of the continental economy. Our three

operating groups serve individuals, businesses, governments

and corporate customers right across Canada and in six

U.S. Midwest states – Illinois, Wisconsin, Indiana, Minnesota,

Missouri and Kansas – as well as in other select locations

in the United States.

Our significant presence in North America is bolstered by

operations in select global markets, including Europe and

Asia, allowing us to provide our North American customers

with access to economies and markets around the world,

and our customers from other countries with access to

North America.